AI-Powered Invoicing App for Freelancers Streamlining Finances.

Ai powered invoicing app for freelancers – AI-powered invoicing app for freelancers represents a significant shift in how independent professionals manage their financial operations. These applications leverage artificial intelligence to automate and optimize the invoicing process, freeing up valuable time and reducing the potential for human error. This technology encompasses a wide range of functionalities, from automatic invoice generation and payment gateway integration to sophisticated financial forecasting and tax preparation assistance.

This comprehensive exploration delves into the core features, advantages, and future possibilities of AI-driven invoicing solutions. We will examine the technical underpinnings of these apps, including the AI algorithms and data security measures that ensure accuracy, efficiency, and protection of sensitive financial data. Furthermore, we will explore the user experience considerations that contribute to a seamless and intuitive workflow for freelancers, as well as the integrations that enable these apps to work in concert with other essential freelance management tools.

Understanding the Core Functionality of an AI-Powered Invoicing App for Freelancers

AI-powered invoicing apps are designed to revolutionize how freelancers manage their finances, shifting from manual, time-consuming processes to automated, efficient workflows. These applications leverage artificial intelligence to streamline invoice creation, payment processing, and financial reporting, offering significant advantages in terms of accuracy, speed, and overall productivity. The core functionality revolves around automating key tasks and providing insightful data analysis to optimize financial operations.

Fundamental Features for Streamlined Financial Operations

To effectively streamline financial operations, an AI-powered invoicing app for freelancers must incorporate several core features that automate key processes and enhance accuracy. These features contribute to a significant reduction in administrative overhead, allowing freelancers to focus on their core competencies.

- Automated Invoice Generation: The app should automatically create invoices based on project details, hours worked, and rates. This feature minimizes manual data entry and reduces the risk of human error.

- Time Tracking Integration: Seamless integration with time-tracking tools allows for automatic calculation of billable hours, ensuring accurate invoicing based on actual work performed.

- Expense Tracking and Management: The ability to track and categorize expenses, linking them to specific projects or clients, provides a comprehensive view of profitability.

- Payment Reminders and Follow-ups: Automated reminders for overdue invoices and payment follow-ups save time and improve cash flow by proactively managing the payment collection process.

- Reporting and Analytics: Comprehensive reporting tools provide insights into financial performance, including revenue, expenses, profit margins, and outstanding invoices.

- Client Management: A centralized system to manage client information, contact details, and project history streamlines communication and organization.

- Currency Conversion and Tax Calculation: Support for multiple currencies and automated tax calculations ensure compliance and accuracy for international clients.

AI-Driven Invoice Generation and Template Variety

AI algorithms are instrumental in automating invoice generation, significantly reducing the manual effort required. This automation hinges on the app’s ability to interpret project details, calculate billable hours, and apply the appropriate rates, all while adhering to the user’s preferred formatting.

The process generally involves the following steps:

- Project Data Input: The freelancer inputs project details, including client name, project description, and agreed-upon rates.

- Time Tracking Data Integration: If integrated with a time-tracking tool, the app automatically imports the hours worked on the project. Otherwise, the freelancer manually inputs the hours.

- Rate Application: The AI algorithm applies the predefined hourly rates or project-based fees.

- Invoice Generation: The algorithm automatically generates the invoice, including all necessary details, such as a breakdown of services, hours, rates, and the total amount due.

- Customization and Formatting: The app offers various invoice templates to choose from, allowing freelancers to customize the appearance of their invoices to match their brand.

Examples of invoice templates:

- Standard Invoice: A basic template including essential information such as client details, invoice number, date, a description of services, hours, rates, and total amount.

- Detailed Invoice: Includes a more comprehensive breakdown of services, potentially with line items for each task performed, along with associated costs and time spent.

- Project-Based Invoice: Designed for projects with fixed fees, specifying the project name, agreed-upon price, and payment terms.

- Hourly Invoice: Specifically for hourly-based work, detailing the number of hours worked, the hourly rate, and the total amount due.

Integration with Payment Gateways and Accounting Software

Integration capabilities are crucial for an AI-powered invoicing app’s effectiveness. These integrations facilitate seamless payment processing and accurate financial record-keeping, enhancing the overall user experience and minimizing manual data entry.

Payment Gateway Integration:

Integration with payment gateways like PayPal, Stripe, and others allows freelancers to receive payments directly through their invoices. The benefits include:

- Faster Payments: Clients can pay invoices quickly and easily online.

- Improved Cash Flow: Faster payment cycles improve cash flow management.

- Reduced Manual Effort: Automates payment tracking and reconciliation.

Potential challenges include:

- Transaction Fees: Payment gateways charge fees for each transaction, which can impact profitability.

- Security Concerns: Ensuring the security of payment data is critical.

- Compatibility Issues: Not all payment gateways may be compatible with the app.

Accounting Software Integration:

Integration with accounting software such as QuickBooks, Xero, or FreshBooks allows for automated data synchronization, providing a holistic view of financial data. The benefits are:

- Automated Data Synchronization: Eliminates the need for manual data entry, reducing the risk of errors.

- Real-time Financial Reporting: Provides up-to-date financial data and insights.

- Improved Efficiency: Streamlines bookkeeping and accounting tasks.

Potential challenges include:

- Data Mapping Complexity: Ensuring accurate mapping of data fields between the invoicing app and the accounting software.

- Compatibility Issues: Not all invoicing apps may integrate with all accounting software.

- Learning Curve: Users may need to learn how to set up and manage the integration.

The Advantages of Using AI to Automate Invoice Creation and Delivery

The integration of Artificial Intelligence (AI) into invoicing applications offers significant advantages for freelancers, streamlining financial processes and improving operational efficiency. By automating key tasks, AI-powered tools minimize human intervention, reducing errors and saving valuable time. This section will explore the specific benefits of leveraging AI in invoice creation, delivery, and follow-up strategies.

Minimizing Manual Data Entry and Human Errors in Invoice Generation

AI significantly reduces the burden of manual data entry, a common source of errors in traditional invoicing. The application utilizes Optical Character Recognition (OCR) technology to automatically extract data from scanned documents such as timesheets, receipts, and project specifications. This eliminates the need for manual typing and data input, decreasing the likelihood of typos, incorrect calculations, and omissions.The AI-powered invoicing app learns and adapts over time, improving its accuracy in data extraction and invoice generation.

The system employs machine learning algorithms to analyze historical data, identify patterns, and predict future requirements. For instance:

- Automated Data Population: The app can automatically populate invoice fields such as client names, addresses, and project details by referencing a pre-existing client database or learning from past invoices. This automation saves time and ensures consistency across invoices.

- Smart Suggestions: Based on project type and past billing rates, the AI can suggest appropriate service descriptions and pricing, reducing the time spent on invoice creation. The app analyzes past projects with similar parameters, proposing service descriptions and pricing structures that are consistent with historical data.

- Error Detection and Correction: The AI continuously monitors invoices for inconsistencies and potential errors. For example, it can flag discrepancies in calculations, missing information, or unusual payment terms, prompting the user to review and correct the invoice before sending it.

- Customization Learning: The app adapts to individual user preferences. If a freelancer consistently uses specific formatting or wording in their invoices, the AI learns these patterns and automatically applies them to future invoices.

This adaptive learning capability allows the app to become more efficient and accurate over time, minimizing human intervention and maximizing productivity. The application can also learn to categorize expenses, improving financial organization.

Optimizing Invoice Delivery for Timely and Professional Communication

AI enhances invoice delivery, ensuring timely and professional communication with clients. The app automates the process of sending invoices via email, optimizing the delivery method for maximum impact. Here’s a table illustrating the key features:

| Feature | Description | Benefit | Example |

|---|---|---|---|

| Automated Email Generation | The app automatically generates emails with pre-written templates or customizable messages. | Saves time and ensures consistent communication. | The app includes a customizable subject line and body text, allowing freelancers to personalize their communication. |

| Email Customization Options | Freelancers can personalize email content, including greetings, payment instructions, and project summaries. | Enhances client relationships and improves payment rates. | The app offers templates for various situations, such as initial invoices, overdue notices, and thank-you emails. |

| Delivery Tracking | The app tracks email opens and clicks, providing insights into client engagement. | Allows freelancers to monitor invoice delivery and identify potential issues. | The system notifies the freelancer when the client opens the invoice and provides the timestamp. |

| Scheduled Delivery | Invoices can be scheduled for delivery at specific times or dates, such as the end of the month or upon project completion. | Ensures timely delivery and improves payment processing. | Freelancers can set invoices to be sent automatically at 9 AM on the last day of each month. |

The app also provides options for sending invoices in various formats, such as PDF or direct links, increasing accessibility for clients. The AI adapts to the client’s preferred communication method, improving the overall delivery experience.

Benefits of AI-Driven Invoice Reminders and Follow-up Strategies

AI-driven invoice reminders and follow-up strategies significantly improve payment collection rates. The app can automatically generate and send personalized reminders based on invoice due dates and client payment history. This proactive approach minimizes late payments and enhances cash flow management.The AI analyzes client behavior and payment history to tailor reminder frequency and content. For example, clients who consistently pay on time may receive fewer reminders, while those with a history of late payments may receive more frequent and assertive communications.The app provides the following functionalities:

- Automated Reminder Scheduling: The system automatically schedules and sends reminders before, on, and after the invoice due date, based on customizable templates.

- Personalized Reminder Content: Reminders can be personalized with the client’s name, project details, and payment instructions. The AI can also adjust the tone and urgency of the reminders based on the client’s payment history.

- Payment History Tracking: The app tracks payment status and automatically updates invoice records upon payment.

- Integration with Payment Gateways: The app can integrate with payment gateways like PayPal or Stripe, allowing clients to pay directly from the invoice and providing instant payment confirmation.

This personalized and automated approach ensures timely payments and strengthens client relationships. By automating the follow-up process, the AI frees up freelancers to focus on core project work.

Exploring the Role of AI in Predicting and Managing Freelancer Finances: Ai Powered Invoicing App For Freelancers

AI-powered invoicing apps extend their utility beyond simple invoice generation, offering powerful tools for financial forecasting and risk management. By analyzing historical data and project parameters, these apps provide freelancers with a forward-looking perspective on their financial health, enabling proactive decision-making. This section delves into the capabilities of AI in predicting income, managing expenses, and simplifying tax preparation for freelancers.

Forecasting Freelancer Income and Expenses

AI excels at pattern recognition, making it an ideal tool for predicting future financial performance. An AI-powered invoicing app analyzes past invoice data, including payment amounts, payment dates, and project durations, to forecast income. It integrates this data with project schedules, incorporating estimated start and end dates, project fees, and payment terms for upcoming work. This comprehensive analysis allows the app to generate income projections, providing a clear picture of expected earnings over specific time periods, such as monthly or quarterly.

The system also factors in expenses. By tracking and categorizing past expenses, the AI can identify spending patterns and predict future costs, including software subscriptions, marketing expenses, and office supplies.The app’s predictive capabilities are enhanced by incorporating external data sources, such as economic indicators or industry trends. For example, if the app detects a potential slowdown in a freelancer’s industry, it can adjust income projections accordingly.

This multi-faceted approach ensures that the financial forecasts are as accurate and realistic as possible. For instance, a freelance web developer using the app might have consistently earned $8,000 per month for the past six months. Based on scheduled projects and the average project duration, the app projects a similar income for the next two months. However, if a major client cancels a project, the app would automatically adjust the forecast, alerting the freelancer to a potential shortfall.

The app can also analyze the freelancer’s spending habits, identifying areas where costs can be reduced to mitigate the impact of the income decrease. This detailed, data-driven approach allows freelancers to proactively manage their finances, making informed decisions about spending, saving, and investment.

Identifying and Mitigating Cash Flow Problems

Cash flow management is crucial for freelancers, and AI can play a pivotal role in identifying and mitigating potential problems. The AI-powered app continuously monitors incoming and outgoing cash flows, comparing projected income with anticipated expenses. If the system detects a potential cash flow shortfall – for example, a delayed payment from a client coupled with upcoming significant expenses – it can issue alerts and suggest proactive measures.For example, a freelance writer has a large invoice due in 60 days, but also has a major software subscription payment due in 30 days.

The AI detects the potential cash flow gap and recommends actions to avoid a financial crisis. The app might suggest:

“Contact the client for a partial payment or expedite payment. Explore options for negotiating a payment plan with the software vendor. Consider temporarily reducing non-essential expenses.”

This proactive approach allows the freelancer to address potential issues before they escalate, maintaining financial stability. The app can also provide simulations, showing the impact of different scenarios on cash flow. For instance, the freelancer can input different payment dates or explore alternative financing options to see how they would affect their financial situation. This ability to model different scenarios empowers freelancers to make informed decisions and maintain control over their finances.

The app’s capacity to identify risks and suggest solutions makes it a valuable tool for managing cash flow and ensuring long-term financial health.

Assisting Freelancers in Tax Preparation

Tax preparation is often a complex and time-consuming task for freelancers. AI-powered apps simplify this process by automating expense categorization and generating reports. The app uses machine learning to automatically categorize expenses based on transaction details, such as descriptions and merchant names.Here are some examples of expense categories:

- Office Supplies: Pens, paper, printer ink, and other items used in a home office.

- Software Subscriptions: Adobe Creative Cloud, project management tools, and other software used for work.

- Marketing and Advertising: Costs associated with promoting services, such as online advertising and social media campaigns.

- Travel: Expenses for business-related travel, including transportation, accommodation, and meals.

- Home Office: A portion of home-related expenses, such as rent or mortgage interest, utilities, and internet access, that are attributable to business use.

The app can also generate reports in various formats, such as profit and loss statements and expense summaries, making it easier to prepare tax returns. These reports provide a clear overview of income, expenses, and profit, enabling freelancers to accurately calculate their taxable income. The app can also integrate with tax preparation software, streamlining the filing process. Furthermore, the AI can provide reminders for tax deadlines and estimated tax payments, helping freelancers avoid penalties and stay compliant with tax regulations.

By automating expense tracking and generating tax-ready reports, the AI-powered app significantly reduces the burden of tax preparation, allowing freelancers to focus on their core business activities.

Comparing Different AI-Powered Invoicing Apps

The landscape of AI-powered invoicing apps is becoming increasingly competitive, with various platforms vying for the attention of freelancers. Understanding the nuances of each app, including its features, pricing, and target audience, is crucial for making an informed decision. This comparison aims to provide a clear and concise overview of three prominent AI-driven invoicing solutions.

Feature Comparison of AI-Powered Invoicing Apps, Ai powered invoicing app for freelancers

To facilitate a direct comparison, a table is provided detailing key features across different platforms. This structured format allows for an easy assessment of functionalities such as automation, payment integrations, and reporting capabilities.

| App Name | Key Features | Payment Integrations | Pricing Model |

|---|---|---|---|

| App A: InvoiceGenius AI | Automated invoice generation from project data, smart payment reminders, AI-driven expense tracking, and predictive financial insights. | PayPal, Stripe, Bank Transfers, Credit Cards | Subscription-based: $19/month (Basic), $39/month (Pro), $79/month (Premium) |

| App B: FinFlow AI | Automated invoice creation based on time tracking and project milestones, advanced reporting dashboards, multi-currency support, and AI-powered forecasting. | PayPal, Stripe, Square, Braintree | Freemium: Limited features for free, Paid plans starting at $29/month |

| App C: InvoiceAI Pro | Customizable invoice templates, automatic tax calculations, integrated CRM features, and AI-powered client communication. | PayPal, Stripe, Authorize.net | Per-invoice: $0.50 per invoice (Basic), Subscription-based with unlimited invoices ($49/month) |

Pricing Model Analysis

The pricing models of AI-powered invoicing apps significantly impact their suitability for different freelancer profiles. The following analysis examines the advantages and disadvantages of each model.

- Subscription-based: This model, employed by InvoiceGenius AI, offers predictable monthly costs, making budgeting straightforward. However, freelancers with low invoice volumes may find it less cost-effective than per-invoice options. It’s best suited for freelancers with consistent workloads and a need for comprehensive features. For instance, a graphic designer who invoices multiple clients monthly would benefit from this model.

- Per-invoice: InvoiceAI Pro’s per-invoice pricing allows freelancers to pay only for what they use. This model is ideal for occasional users or those with fluctuating invoice volumes. However, the per-invoice cost can accumulate for high-volume users, potentially exceeding the cost of a subscription.

- Freemium: FinFlow AI offers a freemium model, attracting users with a free basic version. This is excellent for onboarding new users. However, limitations on features or invoice numbers can necessitate upgrades to paid plans, which may be a barrier for some freelancers.

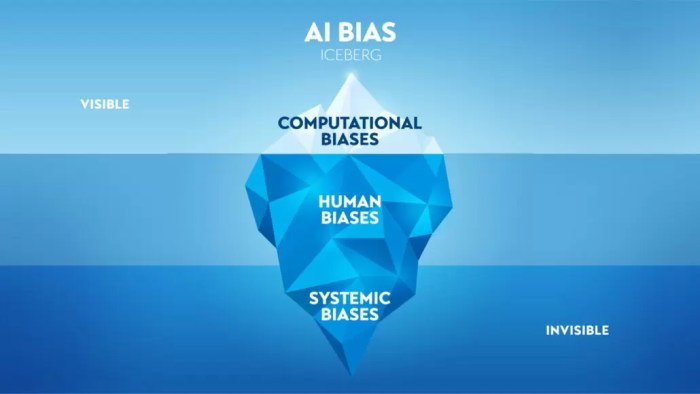

Data Security and Privacy Considerations for AI-Driven Invoicing Solutions

The integration of Artificial Intelligence (AI) into invoicing applications offers significant advantages for freelancers, streamlining financial operations and improving efficiency. However, this technological advancement introduces critical data security and privacy concerns that demand meticulous attention. Freelancers entrust these applications with sensitive financial information, including bank details, client data, and transaction histories. Robust security measures are therefore paramount to protect this data from unauthorized access, breaches, and misuse, ensuring the integrity and confidentiality of financial records.

Failure to adequately address these concerns can lead to severe consequences, including financial losses, reputational damage, and legal repercussions.

Importance of Data Security and Privacy

Data security and privacy are not merely optional features but are fundamental requirements for the credibility and trustworthiness of any AI-powered invoicing solution. Freelancers need to have confidence that their financial information is protected from potential threats. This necessitates a proactive approach from developers, encompassing multiple layers of security to safeguard against various risks.The protection of sensitive financial data in AI-driven invoicing apps is essential for several reasons:

- Preventing Financial Fraud: Secure systems prevent unauthorized access to financial data, thereby reducing the risk of fraudulent activities, such as unauthorized transactions or identity theft.

- Maintaining Confidentiality: Data security ensures that sensitive information, including client details and payment histories, remains confidential and is not disclosed to unauthorized parties. This is critical for maintaining client trust and adhering to professional ethical standards.

- Ensuring Regulatory Compliance: Adherence to data protection regulations, such as GDPR and CCPA, is crucial to avoid legal penalties and maintain the app’s operational legality. Compliance demonstrates a commitment to user privacy and data security.

- Building User Trust: A strong focus on data security and privacy fosters user trust. Freelancers are more likely to use and recommend invoicing apps that demonstrate a commitment to protecting their sensitive information.

Encryption, Data Storage, and Compliance

Implementing robust security measures is crucial to protect user data within AI-driven invoicing solutions. Developers must utilize various strategies to ensure the confidentiality, integrity, and availability of sensitive financial information.Encryption is a fundamental component of data security. Two primary types of encryption are commonly used:

- Encryption in Transit: This protects data as it is transmitted over networks. Secure protocols, such as Transport Layer Security (TLS), encrypt data exchanged between the app and its servers, preventing eavesdropping and data interception.

- Encryption at Rest: This protects data stored on servers. Data is encrypted using algorithms like Advanced Encryption Standard (AES), rendering it unreadable to unauthorized parties, even if they gain access to the physical storage devices.

Data storage practices must also be secure. These practices include:

- Secure Data Centers: Storing data in secure data centers with physical security measures, such as biometric access controls and surveillance, protects against unauthorized physical access.

- Regular Backups: Implementing regular data backups and storing them in geographically diverse locations ensures data availability in the event of a disaster or system failure.

- Access Controls: Restricting access to sensitive data based on the principle of least privilege, ensuring that only authorized personnel can access the necessary information, minimizes the risk of data breaches.

Compliance with data protection regulations is essential. Key regulations include:

- General Data Protection Regulation (GDPR): This European Union regulation requires businesses to obtain explicit consent from users before collecting and processing their personal data. It also mandates the right to access, rectify, and erase personal data, as well as the implementation of data protection by design and by default.

- California Consumer Privacy Act (CCPA): This California law grants consumers the right to know what personal information is collected, to delete their personal information, and to opt-out of the sale of their personal information.

- Other Regulations: Compliance with other relevant regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, is necessary if the app handles sensitive health information.

Assessing Security and Privacy Practices

Before adopting an AI-powered invoicing app, freelancers should conduct a thorough assessment of its security and privacy practices to ensure their financial data is adequately protected. This assessment involves several critical steps.Evaluating security certifications is a crucial first step:

- ISO 27001 Certification: This internationally recognized standard for information security management systems (ISMS) demonstrates that the app provider has implemented a robust framework for managing information security risks.

- SOC 2 Compliance: This standard assesses the security, availability, processing integrity, confidentiality, and privacy of customer data. Compliance reports provide independent verification of the app’s security controls.

Reviewing the privacy policy is essential:

- Transparency: The privacy policy should be clear, concise, and easy to understand, outlining what data is collected, how it is used, and with whom it is shared.

- Data Minimization: The policy should describe the app’s data minimization practices, ensuring that only necessary data is collected and processed.

- Data Retention: The policy should specify how long data is retained and the process for deleting data upon request.

Other critical factors to consider:

- Data Breach Response Plan: Assess whether the app provider has a documented data breach response plan that Artikels the steps to be taken in the event of a security incident.

- User Reviews and Reputation: Research user reviews and the app provider’s reputation for security and privacy. Look for any reports of data breaches or privacy violations.

- Contact Information: Ensure the app provider provides clear contact information for privacy-related inquiries and support.

User Interface and User Experience (UI/UX) Design for Optimal Freelancer Use

The success of an AI-powered invoicing app for freelancers hinges not only on its artificial intelligence capabilities but also on its user interface (UI) and user experience (UX). A well-designed UI/UX ensures that the app is intuitive, efficient, and enjoyable to use, fostering user adoption and maximizing productivity. This section delves into the critical principles of UI/UX design, providing examples of how these principles can be applied to create a superior invoicing experience for freelancers.

Principles of UI/UX Design for User-Friendliness and Accessibility

The creation of a user-friendly and accessible AI-powered invoicing app demands adherence to several core UI/UX design principles. These principles ensure that the app is easy to navigate, understand, and use, regardless of the user’s technical proficiency.

- Intuitive Navigation: The app’s navigation structure should be clear, consistent, and logical. Users should be able to find the information and features they need quickly and easily. This can be achieved through a well-defined information architecture, consistent labeling, and a clear visual hierarchy. For instance, the main actions like “Create Invoice,” “View Invoices,” and “Settings” should be prominently displayed on the main dashboard, accessible with a single click or tap.

- Minimalist Design: A clean and uncluttered interface reduces cognitive load and improves usability. Avoid unnecessary elements and focus on presenting only the essential information. The use of white space, clear typography, and a limited color palette contributes to a visually appealing and user-friendly design.

- Accessibility: The app should be designed to be accessible to users with disabilities. This includes providing alternative text for images, ensuring sufficient color contrast, and supporting keyboard navigation. Following the Web Content Accessibility Guidelines (WCAG) ensures broad usability.

- Feedback and Confirmation: The app should provide clear feedback to the user about their actions. For example, when an invoice is sent, the app should display a confirmation message. Progress indicators should be used for tasks that take time, such as invoice generation or data processing.

- Personalization: Allowing users to customize the app to their preferences, such as setting default invoice templates, payment terms, and currency, enhances the user experience and saves time.

Improving the Freelancer’s Overall Experience Through Well-Designed Apps

A well-designed AI-powered invoicing app can significantly improve a freelancer’s workflow, freeing up valuable time and reducing the stress associated with administrative tasks. This transformation is achieved through several key features and design choices.Consider a freelance graphic designer, Sarah, who previously spent hours manually creating and sending invoices. With a well-designed app, her experience is dramatically different.The app’s AI automatically suggests invoice details based on past projects and client data, minimizing manual data entry.

The interface is intuitive, with a clear dashboard displaying pending payments, overdue invoices, and recent activity. Creating an invoice is a streamlined process: Sarah selects the client, the project, and the services provided, and the app auto-populates the relevant information. She can then customize the invoice with her branding and send it with a single click. The app also integrates with her preferred payment gateway, simplifying the payment process for both her and her clients.

Automated reminders are sent for overdue invoices, freeing Sarah from the need to chase payments. This allows Sarah to spend more time on her design work and less on administrative burdens. As a result, she can manage more clients, increase her income, and enjoy a more fulfilling work-life balance. This increase in efficiency and reduction in administrative overhead ultimately leads to a more profitable and less stressful freelance career.

Mobile Accessibility and Responsiveness for Invoicing Management

Mobile accessibility and responsiveness are paramount in today’s mobile-first world. Freelancers need to be able to access and manage their invoices from any device, anytime, anywhere. This necessitates a design that adapts seamlessly to different screen sizes and orientations.The app’s interface should be designed with a “mobile-first” approach, meaning that the design starts with the mobile experience and then scales up to larger screens.

- Smartphone Interface: On a smartphone, the interface should be clean and optimized for touch interactions. Key elements, such as buttons and form fields, should be large enough to be easily tapped. The navigation should be streamlined, with a clear menu and easy access to core functions. For example, the invoice creation process should be broken down into clear, concise steps, with a progress indicator to guide the user.

- Tablet Interface: On a tablet, the interface can take advantage of the larger screen size to display more information at once. The layout can be more complex, with sidebars or dashboards to provide quick access to key data and features. The user interface can also incorporate larger previews and more detailed charts.

- Desktop Interface: On a desktop, the interface can provide a full-featured experience, with a wider range of features and customization options. The layout can be more complex, with multiple panels and sections to display a wealth of information. The app should also provide keyboard shortcuts for quick navigation and actions.

- Responsive Design: The app should utilize responsive design techniques to ensure that the layout adapts to different screen sizes and orientations. This includes using flexible grids, fluid images, and media queries to dynamically adjust the content and layout.

Integration with Other Freelance Management Tools and Platforms

The utility of an AI-powered invoicing app is significantly amplified through seamless integration with other tools frequently employed by freelancers. This interconnectedness streamlines workflows, reduces manual data entry, and provides a more holistic view of a freelancer’s business operations. The ability to connect various platforms enhances efficiency, accuracy, and overall productivity, contributing to a more organized and financially sound freelance practice.

Detailed Integration Capabilities

AI-powered invoicing apps are designed to integrate with a variety of freelance management tools, creating a unified and efficient ecosystem. These integrations often leverage Application Programming Interfaces (APIs) to facilitate data exchange and automate tasks. This interoperability is crucial for modern freelancers managing diverse projects and client relationships.

- Project Management Software: Integration with project management tools such as Asana, Trello, or Monday.com enables automatic invoice generation based on project milestones, completed tasks, or time spent. For instance, when a project phase is marked as “complete” in Asana, the invoicing app can automatically generate and send an invoice to the client.

- Benefits:

- Automated data synchronization eliminates manual data entry and reduces the risk of errors.

- Improved accuracy ensures invoices reflect the actual work completed and the agreed-upon deliverables.

- Streamlined workflows reduce administrative overhead, allowing freelancers to focus on core project tasks.

- Time Tracking Apps: Integration with time tracking apps like Toggl Track or Harvest allows the invoicing app to automatically generate invoices based on tracked hours and hourly rates. This ensures accurate billing for time-based projects and eliminates the need for manual time calculations.

- Benefits:

- Accurate time tracking provides precise billing based on worked hours.

- Automated invoice generation based on time entries ensures timely and accurate invoicing.

- Reduced manual effort saves time and minimizes the chance of billing discrepancies.

- Client Relationship Management (CRM) Systems: Integration with CRM platforms like HubSpot or Pipedrive facilitates the management of client information, payment history, and communication logs. This enables the invoicing app to automatically populate invoice details with client information from the CRM and track payment statuses within the CRM.

- Benefits:

- Centralized client data access allows for easier invoice creation and management.

- Improved communication enables timely follow-up on invoices and payment reminders.

- Enhanced client relationship management facilitates better financial oversight and client interaction.

Future Integration Prospects

The freelance tool ecosystem is constantly evolving, presenting opportunities for further integration and enhanced functionality. AI’s role in these future integrations will be critical, particularly in predicting future cash flow, automating complex tasks, and providing proactive financial insights. As more specialized freelance tools emerge, the ability of AI-powered invoicing apps to seamlessly integrate will become even more important.Consider the potential for predictive analytics: an AI-powered invoicing app could analyze historical payment data, project timelines, and client behavior to forecast future income and identify potential late payments.

This would enable freelancers to proactively manage their finances and mitigate risks. AI could also facilitate more complex integrations, such as automatically adjusting invoice templates based on client preferences or integrating with tax preparation software to simplify tax filing.The development of standardized APIs and open-source platforms will further drive integration, allowing for more effortless data exchange and interoperability between different freelance tools.

The evolution of AI will contribute to increasingly sophisticated and user-friendly integrations, empowering freelancers to operate more efficiently and make data-driven decisions. The trend points towards a more connected and intelligent freelance ecosystem, where AI-powered invoicing apps play a central role in simplifying financial management and maximizing productivity.

Customization Options and Branding Capabilities within AI-Powered Invoicing Apps

Customization options are a critical feature of AI-powered invoicing applications, directly influencing a freelancer’s ability to project a professional image and maintain brand consistency. These options go beyond mere aesthetics, impacting client perception, trust, and ultimately, the success of the freelance business. The ability to tailor invoices to match a freelancer’s brand identity is a fundamental aspect of establishing a strong professional presence.

Importance of Customization Options in AI-Powered Invoicing Apps

Customization within AI-powered invoicing applications empowers freelancers to create invoices that reflect their unique brand identity. This personalization fosters a stronger professional image, helping freelancers differentiate themselves from competitors. By integrating branding elements and customizing invoice layouts, freelancers can create a cohesive brand experience for their clients, enhancing recognition and recall. Moreover, detailed customization options provide freelancers with control over the information presented, ensuring invoices are clear, concise, and tailored to the specific needs of each client.

This level of control contributes to increased client satisfaction and reinforces the freelancer’s commitment to delivering high-quality services. The flexibility offered by these applications enables freelancers to adapt their invoicing process to their evolving business needs and maintain a consistent brand presence.

Examples of Customization Features

The effectiveness of AI-powered invoicing apps hinges on the breadth and depth of their customization options. Several features are essential for ensuring invoices are both professional and aligned with a freelancer’s brand.

| Feature | Description | Example | Benefit |

|---|---|---|---|

| Branding Elements | Allows integration of a freelancer’s logo, brand colors, and fonts. | Uploading a high-resolution logo to the invoice header; selecting brand-specific color palettes for text, borders, and backgrounds. | Enhances brand recognition and reinforces professional identity, creating a consistent brand experience. |

| Custom Fields | Provides the ability to add custom fields to invoices, such as project codes, client PO numbers, or specific payment instructions. | Adding a “Project ID” field to track specific projects; including a custom message like “Thank you for your business!” | Ensures invoices include all necessary information, catering to specific client requirements and project details, streamlining the payment process. |

| Invoice Templates | Offers pre-designed invoice templates with customizable layouts and formatting options. | Selecting a template with a clean, minimalist design; modifying the template to include a custom header and footer. | Provides a professional starting point, saving time and ensuring consistency in invoice design. |

| Payment Terms and Methods | Enables freelancers to specify payment terms, including due dates, late payment fees, and accepted payment methods. | Setting payment terms to “Net 30” days; specifying accepted payment methods like PayPal, Stripe, and bank transfers. | Clarifies payment expectations, reducing the likelihood of payment delays and providing clients with convenient payment options. |

Contribution of Customization and Branding to Freelancer Professionalism

The ability to customize and brand invoices significantly impacts a freelancer’s professional image and client perception. By incorporating branding elements, freelancers establish a consistent visual identity that reinforces their brand recognition and builds trust. A well-designed, branded invoice demonstrates attention to detail and professionalism, signaling to clients that the freelancer values their business. This, in turn, can lead to increased client satisfaction and a higher likelihood of repeat business.

The inclusion of custom fields allows freelancers to tailor invoices to the specific needs of each client, further enhancing the perception of personalized service. The availability of clear and concise invoices reduces the likelihood of payment disputes and streamlines the payment process, contributing to a more positive client experience.

Real-World Examples of Freelancers Benefiting from AI-Powered Invoicing

The adoption of AI-powered invoicing apps is rapidly transforming the landscape of freelance financial management. These applications provide tangible benefits, streamlining workflows, minimizing errors, and ultimately contributing to enhanced business growth. This section explores specific instances where freelancers have successfully leveraged AI-driven invoicing solutions to improve their operational efficiency and financial outcomes.

Detailed Case Studies

Numerous freelancers have reported significant improvements after implementing AI-powered invoicing systems. These systems automate many of the traditionally time-consuming aspects of invoicing, freeing up valuable time for core project work and client acquisition.

- Case Study 1: Sarah, a freelance graphic designer. Sarah, a graphic designer, previously spent several hours each week creating and sending invoices manually. This process was prone to errors, particularly regarding calculations and due dates. After adopting an AI-powered invoicing app, Sarah reported a 60% reduction in time spent on invoicing. The app automatically generated invoices based on her project data, tracked payments, and sent automated reminders.

She also stated, “The AI-powered app has been a game-changer. I no longer have to worry about chasing payments, and I can focus on my creative work.”

- Case Study 2: John, a freelance software developer. John experienced challenges in cash flow management due to inconsistent payment schedules and late payments. The AI-powered app he chose offered predictive analytics that helped him forecast his income and identify potential cash flow issues. The app also provided automated payment reminders and integrated with his bank account for faster reconciliation. John reported a 30% improvement in on-time payments and a better understanding of his financial position.

He emphasized, “The predictive analytics feature gave me much-needed visibility into my finances, enabling me to plan better and avoid financial stress.”

- Case Study 3: Maria, a freelance writer. Maria struggled with keeping track of project expenses and generating accurate invoices that reflected these costs. The AI-powered app she selected allowed her to link expenses directly to projects, automatically calculating and including them in her invoices. She also appreciated the app’s ability to generate professional-looking invoices that enhanced her brand image. Maria commented, “The ability to integrate expenses and create professional invoices has made me appear more organized and professional to my clients.”

Positive Impact on Freelancers’ Productivity and Business Growth

The implementation of AI-powered invoicing solutions has a profound impact on freelancers’ productivity and business development. By automating repetitive tasks and providing valuable insights into financial performance, these apps empower freelancers to focus on their core competencies and pursue opportunities for growth.The primary benefit is a significant increase in available time. The automation of invoice creation, delivery, and payment tracking frees up hours previously spent on administrative tasks.

This time can be redirected toward project work, client communication, and business development activities. For instance, consider a freelance writer who spends an average of 5 hours per week on invoicing. With an AI-powered app, this time could be reduced to 2 hours, freeing up 3 hours for writing or client outreach.Moreover, AI-powered invoicing apps contribute to improved financial management.

Features such as automated payment reminders and cash flow forecasting enable freelancers to proactively manage their finances, reduce late payments, and make informed business decisions. For example, a freelance developer using a system with predictive analytics might identify a potential dip in income in the coming month and proactively seek new projects to mitigate the risk. This proactive approach leads to greater financial stability and peace of mind.Furthermore, these apps often provide insights into key performance indicators (KPIs), such as average invoice value, payment timelines, and client profitability.

This data allows freelancers to evaluate their business performance, identify areas for improvement, and make strategic decisions to enhance their profitability and growth. A graphic designer, for instance, might use these KPIs to identify which client projects are most profitable and allocate resources accordingly. Ultimately, AI-powered invoicing is a catalyst for increased productivity, improved financial health, and sustainable business growth for freelancers.

The Future of AI in Freelance Invoicing

The trajectory of AI-powered invoicing for freelancers is poised for significant advancement, driven by emerging trends in automation, predictive analytics, and enhanced user experience. The evolution will reshape how freelancers manage their financial operations, offering greater efficiency, accuracy, and control. This future hinges on integrating advanced technologies, improving existing functionalities, and adapting to the dynamic needs of the freelance economy.

Emerging Trends and Future Developments in AI-Powered Invoicing

AI-powered invoicing is evolving beyond basic automation. The trend is toward advanced features that enhance the financial management capabilities of freelancers. These developments aim to streamline processes, improve accuracy, and provide deeper insights into financial performance.* Advanced Automation: AI will automate more complex tasks. This includes automatically categorizing expenses, matching payments to invoices, and generating financial reports with minimal user input.

The goal is to reduce manual effort and human error.* Predictive Analytics: AI will forecast future income, identify potential late payments, and offer personalized financial advice. This predictive capability allows freelancers to proactively manage their finances, mitigating risks and optimizing cash flow. For instance, an AI could analyze historical invoice data to predict when a client is likely to pay late, allowing the freelancer to send a reminder in advance.* Enhanced User Experience (UX): AI will personalize the user interface and adapt to individual user preferences.

This includes offering customized dashboards, providing context-sensitive help, and integrating with other freelance management tools seamlessly. The result is a more intuitive and efficient user experience.* Integration of Blockchain Technology: Blockchain technology will secure transactions and verify invoice authenticity, enhancing trust and transparency. This integration provides a secure and immutable record of all financial transactions, reducing the risk of fraud and disputes.* Expansion of Natural Language Processing (NLP): NLP will allow for more natural and intuitive interaction with the invoicing app.

Freelancers can use voice commands to generate invoices, track payments, and manage their finances.

Improving Invoice Processing with AI

AI will transform invoice processing, enhancing security, efficiency, and management capabilities. These improvements will benefit freelancers by streamlining workflows and reducing the administrative burden.The integration of blockchain technology and NLP will revolutionize invoice processing.* Blockchain for Secure Transactions: Blockchain technology provides a secure and transparent ledger for all invoice transactions. Each invoice is recorded as a block, linked to the previous one, creating an immutable chain.

This ensures the integrity of financial data and reduces the risk of fraudulent activities.

“Blockchain’s immutable nature guarantees that once an invoice is recorded, it cannot be altered, providing a high level of security and trust in financial transactions.”

Natural Language Processing (NLP) for Enhanced Management

NLP enables more efficient invoice management. AI can understand and interpret natural language, allowing freelancers to interact with the invoicing system using voice commands or natural language queries. For example, a freelancer could say, “Show me all unpaid invoices from this client,” and the system would respond instantly.

Automated invoice generation from project descriptions.

Intelligent payment reminders tailored to client payment history.

Automated categorization of invoice line items.

Evolution of AI-Powered Invoicing Apps for the Future

AI-powered invoicing apps will evolve to meet the changing needs of freelancers. These changes will introduce new features and functionalities, offering greater efficiency and control over financial management. The future will be characterized by personalization, proactive financial management, and seamless integration.* Personalized Financial Dashboards: Apps will provide customized dashboards that display key financial metrics, such as income, expenses, and outstanding invoices.

AI will analyze user data to identify trends, predict future cash flow, and offer personalized financial advice.* Proactive Payment Reminders and Dispute Resolution: AI will proactively send payment reminders based on the client’s payment history and the terms of the invoice. It will also facilitate dispute resolution by providing evidence and facilitating communication between the freelancer and the client.* Automated Expense Tracking and Reporting: AI will automatically track and categorize expenses, generating detailed financial reports with minimal user input.

Integration with banking and credit card accounts will streamline expense management.* Advanced Integration with Other Tools: AI-powered invoicing apps will integrate seamlessly with other freelance management tools, such as project management software, time tracking apps, and CRM systems. This integration will provide a holistic view of the freelancer’s business.* Predictive Financial Planning: AI will provide predictive financial planning tools, forecasting future income, expenses, and cash flow.

This will enable freelancers to make informed financial decisions and plan for the future. For example, the app could analyze historical data to predict the freelancer’s income over the next six months, considering factors such as project timelines and client payment patterns.

Troubleshooting Common Issues and Finding Support for AI-Powered Invoicing Apps

AI-powered invoicing apps, while designed to streamline financial management for freelancers, are not immune to technical challenges. Understanding and proactively addressing potential issues is crucial for maximizing the benefits of these tools. This section details common problems encountered, provides step-by-step troubleshooting guidance, and Artikels resources available to ensure freelancers can effectively utilize these platforms.

Common Issues Freelancers May Encounter

Freelancers may face several recurring challenges when integrating and using AI-powered invoicing applications. These issues often stem from integration complexities, data migration difficulties, or unexpected technical glitches. Identifying these potential pain points allows for a more prepared and efficient user experience.

- Integration Problems: Connecting the invoicing app with existing tools, such as payment gateways, accounting software, and project management platforms, can sometimes fail. This can result in data synchronization errors, payment processing delays, or incomplete financial records.

- Data Migration Challenges: Migrating data from previous invoicing systems or spreadsheets can be complex. Incorrect data imports, missing information, or formatting inconsistencies may arise, leading to inaccurate financial reports and potential tax complications.

- Technical Glitches: Software bugs, server issues, or unexpected errors can disrupt the app’s functionality. This can manifest as invoice generation failures, delayed notifications, or intermittent access to the platform.

- Payment Processing Difficulties: Issues with payment gateway integrations, such as rejected transactions or incorrect currency conversions, can lead to payment delays and affect cash flow.

- AI Algorithm Anomalies: While AI enhances features like expense categorization and invoice prediction, inaccuracies in these algorithms can sometimes occur. This might lead to incorrect expense classifications or inaccurate payment forecasting.

- User Interface (UI) and User Experience (UX) Issues: Difficulties in navigating the app, understanding features, or customizing settings can hinder efficient use, leading to frustration and reduced productivity.

Step-by-Step Solutions for Troubleshooting Common Issues

Effective troubleshooting requires a systematic approach. The following steps and examples offer practical solutions to common problems, along with the necessary support resources to resolve them.

- Integration Problems:

- Solution: Verify the API keys and connection settings for all integrated platforms. Check for compatibility issues between the invoicing app and the other services. Consult the app’s documentation or contact customer support for specific integration instructions.

- Example: If a freelancer’s Stripe integration fails, they should first ensure the API keys entered in the invoicing app match those in their Stripe account. Then, they should consult the app’s documentation for troubleshooting steps specific to Stripe integration.

- Data Migration Challenges:

- Solution: Back up existing data before migrating. Use the app’s import templates to ensure data is formatted correctly. Validate imported data for accuracy and completeness. Contact customer support for assistance with complex migrations.

- Example: A freelancer migrating from a spreadsheet should first export their data as a CSV file. Then, they should use the invoicing app’s import template to format the CSV data correctly, ensuring that all relevant fields are mapped accurately.

- Technical Glitches:

- Solution: Restart the app and clear the cache. Check the app’s status page for known issues or outages. Update the app to the latest version. If the problem persists, contact customer support and provide detailed information about the error.

- Example: If an invoice fails to generate, the freelancer should first try restarting the app and clearing the cache. If the issue continues, they should check the app’s status page for reported incidents. If no issues are reported, they should contact customer support, providing the invoice details and any error messages received.

- Payment Processing Difficulties:

- Solution: Double-check payment gateway settings and transaction details. Verify that the payment gateway supports the currency and payment methods used. Contact the payment gateway provider or the invoicing app’s support team for assistance.

- Example: If a payment is rejected, the freelancer should first confirm the recipient’s payment details. If the issue persists, they should check the payment gateway’s transaction logs for specific error codes and consult the gateway’s support documentation.

- AI Algorithm Anomalies:

- Solution: Review and correct any misclassified expenses or inaccurate invoice predictions. Provide feedback to the app developers to improve the AI algorithms. Manually adjust the settings if needed.

- Example: If the AI incorrectly categorizes an expense, the freelancer should manually edit the category and provide feedback to the app developers. For invoice predictions, the freelancer can review the generated estimates and manually adjust them based on their knowledge of the project.

Resources for Finding Support and Assistance

Access to comprehensive support resources is critical for resolving issues and optimizing the use of AI-powered invoicing apps. Various channels are available to assist freelancers, including online forums, tutorials, and community groups.

- Online Forums: Many invoicing app providers host online forums where users can ask questions, share solutions, and receive support from other users and the app’s developers. These forums often have searchable databases of frequently asked questions and troubleshooting guides.

- Tutorials and User Guides: Detailed tutorials and user guides are usually available on the app’s website or within the app itself. These resources provide step-by-step instructions on using features, troubleshooting common issues, and customizing settings.

- Customer Support: Most invoicing apps offer customer support through email, live chat, or phone. Customer support representatives can provide personalized assistance with technical issues, integration problems, and account-related inquiries.

- Community Groups: Freelancer communities and professional organizations often have dedicated groups or forums where users of specific invoicing apps can share tips, ask questions, and offer support to each other.

- Knowledge Bases: Comprehensive knowledge bases containing articles, FAQs, and troubleshooting guides are available on the app’s website. These knowledge bases provide a self-service resource for addressing common issues.

Closure

In conclusion, the integration of AI into invoicing apps has transformed the financial landscape for freelancers. These tools offer substantial benefits, including enhanced automation, improved accuracy, and data-driven insights. As AI technology continues to evolve, we can anticipate even more sophisticated features, further streamlining the financial management processes and empowering freelancers to focus on their core work and business growth.

The future of freelance invoicing is undoubtedly intertwined with the continued development and adoption of AI-powered solutions.

FAQ Corner

How does an AI-powered invoicing app differ from traditional invoicing software?

AI-powered apps utilize machine learning to automate tasks such as invoice generation, payment reminders, and financial forecasting, going beyond basic invoice creation and offering proactive financial management capabilities.

What security measures are typically in place to protect my financial data?

These apps typically employ encryption, secure data storage practices, and compliance with data protection regulations (e.g., GDPR, CCPA) to safeguard sensitive financial information.

Can I customize the invoices generated by these apps?

Yes, most AI-powered invoicing apps offer extensive customization options, including branding elements, custom fields, and invoice templates, allowing freelancers to create professional and personalized invoices.

How do these apps handle different currencies and tax regulations?

Reputable apps support multiple currencies and often integrate with tax calculation and reporting tools to ensure compliance with relevant tax regulations in various regions.

What kind of support is available if I encounter problems?

Most apps provide customer support through various channels, including FAQs, user guides, email, and sometimes live chat or phone support, to help users resolve any issues.