Embarking on a journey into the realm of FinOps, we uncover a fascinating intersection with gamification, a strategy that transforms complex processes into engaging experiences. This approach, designed to encourage cloud cost optimization, introduces an element of playfulness to the serious business of managing cloud spending. By understanding the core principles of gamification and FinOps, we can unlock significant cost savings and foster a culture of financial responsibility within organizations.

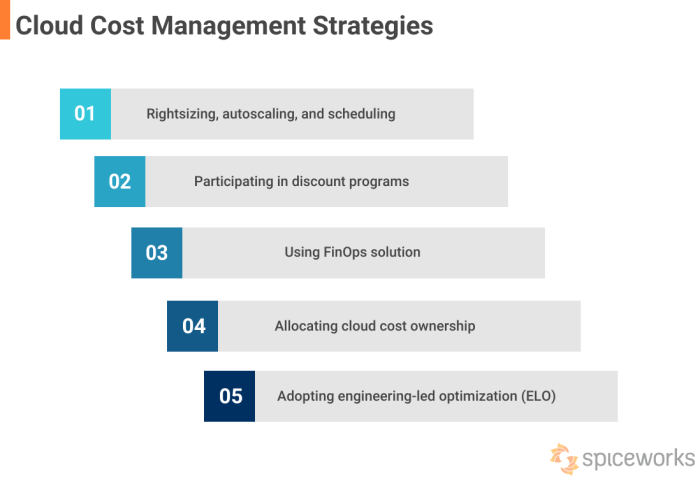

FinOps, the practice of cloud financial management, aims to help businesses get the most value out of their cloud investments. Gamification, in this context, leverages game-design elements to motivate and engage individuals and teams to adopt cost-saving behaviors. This involves setting goals, providing feedback, and rewarding achievements, ultimately driving efficiency and reducing waste in cloud spending. This guide will delve into the intricacies of implementing gamification within a FinOps framework, exploring the benefits, strategies, and practical steps involved.

Introduction to Gamification in FinOps

Gamification, the application of game-design elements and game principles in non-game contexts, is increasingly finding its way into various business practices. In the context of FinOps, gamification offers a novel approach to encourage cost optimization and efficient cloud resource management. By incorporating game mechanics, such as points, badges, leaderboards, and rewards, FinOps teams can foster greater engagement, motivation, and a sense of accomplishment in achieving cost-saving goals.

Defining FinOps and Its Objectives

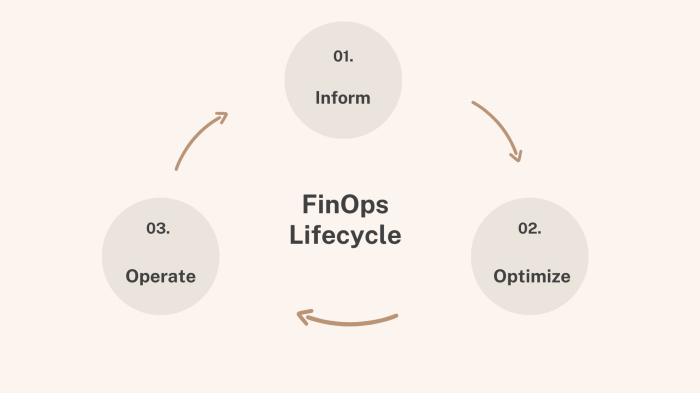

FinOps, short for Financial Operations, is an evolving cloud financial management discipline that enables organizations to understand their cloud costs and make data-driven decisions to optimize cloud spending. The primary goals of FinOps are to: improve financial accountability, accelerate cloud adoption, increase business value, and enhance the speed and agility of cloud operations. FinOps teams work collaboratively across engineering, finance, and business units to achieve these objectives.

They focus on real-time visibility into cloud spending, cost allocation, forecasting, and optimization strategies.

Potential Benefits of Gamification in a FinOps Framework

Integrating gamification within a FinOps framework can provide several advantages, significantly enhancing the effectiveness of cost optimization efforts.The integration of gamification within FinOps can yield substantial benefits, including:

- Enhanced Engagement and Motivation: Game mechanics naturally increase user engagement. By incorporating elements like points, badges, and leaderboards, FinOps teams can make cost optimization a more engaging and motivating process. This can lead to increased participation in cost-saving initiatives and a stronger sense of ownership.

- Improved Cost Awareness: Gamification can make cloud spending more visible and understandable. For instance, visualizing cost data through dashboards with points or levels can help teams quickly grasp their spending patterns and identify areas for improvement.

- Behavioral Change: Gamification encourages desired behaviors, such as identifying and eliminating unused resources, optimizing instance sizes, and implementing cost-effective architectural changes. Rewarding these behaviors reinforces positive habits and promotes a culture of cost consciousness.

- Data-Driven Decision Making: By tracking performance metrics, gamification provides valuable insights into the effectiveness of cost optimization efforts. This data can be used to refine strategies, set realistic goals, and make informed decisions about cloud resource allocation.

- Increased Collaboration: Gamified FinOps initiatives often encourage collaboration across teams. Leaderboards and team-based challenges can foster a competitive yet collaborative environment, where teams work together to achieve shared cost-saving goals.

Understanding the Target Audience for Savings

Identifying and understanding the various stakeholders within an organization is crucial for the successful implementation of gamification in FinOps. Tailoring the approach to each audience ensures that cost-saving behaviors are effectively encouraged and that the overall FinOps goals are achieved. This section will delve into the key roles and stakeholders, detailing the specific cost-saving behaviors that are most relevant to them.

Identifying Roles and Stakeholders

Successful FinOps initiatives require a multi-faceted approach, engaging various teams and individuals. The following roles are key stakeholders in any organization aiming to optimize cloud spending:

- Engineering Teams: They are responsible for the design, development, and deployment of applications, and have direct control over resource utilization.

- Product Managers: They define product roadmaps and features, influencing resource allocation based on product needs.

- Finance Teams: They monitor and analyze cloud spending, providing insights and financial controls.

- FinOps Practitioners: They act as the central point, bridging the gap between engineering, finance, and business teams, driving the FinOps strategy.

- Executive Leadership: They set the overall strategic direction and provide support for FinOps initiatives.

Cost-Saving Behaviors by Role

Each role requires a different approach to encourage cost-saving behaviors. Here’s a breakdown of the desired actions for each stakeholder:

- Engineering Teams: Should focus on optimizing resource usage through right-sizing instances, utilizing reserved instances or savings plans, and implementing auto-scaling. They should also be encouraged to write efficient code and regularly monitor their cloud infrastructure for waste.

- Product Managers: Should prioritize features and initiatives that offer the best return on investment, considering the cost implications of different product decisions. They should also be involved in cost-benefit analyses for new features.

- Finance Teams: Should establish clear budget allocation and tracking mechanisms, provide detailed cost reports, and identify cost-saving opportunities. They should also collaborate with engineering and product teams to understand and forecast cloud spending.

- FinOps Practitioners: Should educate and train the different teams, facilitate communication, and implement cost-optimization tools and processes. They should also monitor the effectiveness of FinOps initiatives and adjust the strategy as needed.

- Executive Leadership: Should champion the FinOps initiative, provide the necessary resources, and establish clear cost-saving goals. They should also foster a culture of cost awareness and accountability.

Cost-Conscious vs. Cost-Unaware Personas

Creating personas helps tailor gamification efforts. These two examples illustrate the extremes of cloud cost awareness:

- Cost-Conscious Team Member:

- Name: Sarah, Senior Software Engineer

- Background: Sarah has been with the company for five years and is highly experienced in cloud technologies. She is proactive about learning new optimization techniques and is always looking for ways to improve efficiency.

- Behaviors: Regularly reviews cloud resource usage, proactively identifies and fixes inefficiencies, and shares cost-saving tips with her team.

- Motivations: Driven by a desire to be a high performer, and understands the impact of her actions on the company’s financial health.

- Gamification Focus: Rewards such as badges for identifying savings, leaderboards showcasing efficient code, and recognition for cost-saving contributions.

- Cost-Unaware Team Member:

- Name: John, Junior Software Engineer

- Background: John is new to the company and is still learning about cloud cost management. He focuses on getting his tasks done quickly and efficiently, but may not be aware of the cost implications of his decisions.

- Behaviors: May over-provision resources, deploy inefficient code, and not regularly monitor cloud spending.

- Motivations: Primarily focused on completing his tasks and meeting deadlines.

- Gamification Focus: Introductory training modules, points for completing cost-saving tasks, and visual dashboards displaying the impact of his actions. The focus should be on education and awareness.

Designing Gamified Elements for FinOps

Creating engaging gamified elements is crucial for successfully implementing FinOps and encouraging cloud cost optimization. By leveraging game mechanics, we can motivate teams to actively participate in cost-saving initiatives and foster a culture of accountability and efficiency. This section will detail the design of several key gamified elements.

Design a points system for tracking cloud spending and savings, with examples.

A points system provides a quantifiable way to measure progress and reward desired behaviors related to cloud cost management. This system should be transparent, easily understood, and directly tied to specific actions that contribute to savings. Points can be awarded for a variety of activities, encouraging teams to be proactive in their FinOps efforts.Here’s an example of a points system:

- Identifying and remediating idle resources: Award 10 points per instance remediated. This encourages teams to regularly review their infrastructure and eliminate unused resources.

- Implementing cost-effective instance types: Award 5 points per instance migrated to a cheaper, yet suitable, instance type. For example, migrating a development server from a general-purpose instance to a burstable instance.

- Implementing automated scaling: Award 15 points per application with implemented autoscaling. This ensures resources are used efficiently, scaling up during peak demand and down during low usage.

- Deleting unused storage volumes: Award 8 points per deleted storage volume. This reduces unnecessary storage costs.

- Implementing Reserved Instances or Savings Plans: Award 20 points per successful implementation of a Reserved Instance or Savings Plan. This is a more strategic approach to cost reduction.

- Reporting cost anomalies: Award 5 points for identifying and reporting a significant cost anomaly. This encourages proactive monitoring.

The total points earned can be used to determine team standings, award badges, and provide other incentives. The points system should be regularly reviewed and adjusted to reflect changing business priorities and cloud cost optimization best practices. Points could be calculated and displayed via a dashboard or reporting tool. For example, the formula for calculating points earned from savings could be:

Points = (Monthly Savings / Baseline Monthly Spend) – 100

This formula provides a percentage-based score, making it easier to compare savings across different teams or projects with varying cloud spending baselines.

Methods for Tracking and Displaying Savings

Effectively tracking and displaying savings is crucial for the success of any FinOps gamification initiative. It provides visibility into the impact of user actions, reinforces desired behaviors, and fosters a culture of cost optimization. This section Artikels various methods for visualizing savings, providing real-time feedback, and generating performance reports.

Visualizing Cost Savings with Charts and Graphs

A well-designed FinOps dashboard is essential for communicating cost savings effectively. Using charts and graphs allows for the clear and concise presentation of complex financial data, making it easier for users to understand their impact.

- Line Graphs: These are ideal for displaying trends over time. For instance, a line graph can illustrate the monthly cloud spending, showing the impact of cost-saving initiatives. Users can quickly see if spending is decreasing or increasing, and by how much. This is a great way to visualize the effect of actions over time.

- Bar Charts: Bar charts are effective for comparing different cost categories or teams. For example, a bar chart can compare the spending of different departments, highlighting which teams are most successful at cost optimization. This promotes friendly competition and encourages collaboration.

- Pie Charts: Pie charts are useful for showing the proportion of spending within different services or resource types. They can illustrate where the majority of cloud spending is allocated, helping users to identify areas for optimization. For example, a pie chart might show that 40% of cloud spending is on compute instances, allowing teams to focus on optimizing instance utilization.

- Dashboard Integration: Integrating these charts and graphs into a centralized FinOps dashboard provides a single source of truth for cost information. The dashboard should be accessible to all relevant users and updated regularly with the latest data.

Real-Time Feedback Mechanisms

Providing real-time feedback is critical for reinforcing positive behaviors and driving continuous cost optimization. Instant feedback helps users understand the immediate impact of their actions.

- Notifications: Implement notifications that alert users when they achieve a cost-saving milestone or when their actions result in a significant change in spending. These notifications can be delivered via email, Slack, or within the FinOps dashboard itself.

- Leaderboards: Display leaderboards that rank users or teams based on their cost-saving performance. This fosters a sense of competition and encourages users to strive for better results.

- Progress Bars: Use progress bars to show users how close they are to achieving a specific cost-saving goal. This provides a clear visual representation of their progress and motivates them to continue optimizing.

- Personalized Insights: Provide users with personalized insights and recommendations based on their spending patterns. For example, the system can suggest specific actions they can take to reduce their cloud costs, such as right-sizing instances or deleting unused resources.

- Example: Imagine a team implementing a new instance type that costs less. The real-time feedback mechanism could instantly display the savings achieved, for example, “$500 saved this month by using the new instance type”.

Generating Reports for Savings Performance

Regular reporting is essential for tracking the overall success of the FinOps gamification initiative and identifying areas for improvement. Reports should highlight individual and team savings performance, as well as provide insights into the impact of specific initiatives.

- Individual Performance Reports: These reports should summarize each user’s cost-saving contributions, including the specific actions they took and the resulting savings.

- Team Performance Reports: Team reports should aggregate the cost-saving performance of all team members, allowing for comparison across different teams. This fosters a sense of collaboration and accountability.

- Initiative-Specific Reports: Reports can be generated to track the impact of specific cost-saving initiatives, such as rightsizing instances or implementing auto-scaling. This allows for evaluating the effectiveness of these initiatives and making data-driven decisions.

- Report Frequency: Reports should be generated regularly, such as weekly or monthly, to provide timely feedback and track progress over time.

- Report Content: The reports should include both quantitative data (e.g., dollar savings, percentage reduction in costs) and qualitative insights (e.g., descriptions of the actions taken and the challenges encountered).

- Example: A monthly report could show that Team A saved $2,000 by rightsizing their instances, while Team B saved $1,500 by deleting unused resources. This allows for comparing performance and sharing best practices.

Rewards and Incentives for Savings Behavior

Motivating users to actively participate in FinOps and embrace cost-saving behaviors is crucial for the success of any gamification strategy. A well-designed rewards and incentives program can significantly boost engagement and foster a culture of cost consciousness. It’s important to carefully consider the types of rewards offered, the balance between monetary and non-monetary incentives, and potential pitfalls to ensure the program’s effectiveness and sustainability.

Types of Rewards

A variety of rewards can be used to motivate users and encourage them to adopt cost-saving behaviors within a FinOps gamification framework. The key is to offer rewards that are both appealing and aligned with the desired outcomes.

- Virtual Badges and Achievements: These are digital recognitions awarded for specific actions, such as identifying a cost-saving opportunity, implementing a resource optimization strategy, or consistently meeting savings targets. For example, a “Resource Optimizer” badge could be awarded for identifying and implementing unused resource deletion. This approach leverages the human desire for recognition and accomplishment.

- Public Recognition: Highlighting individuals or teams who achieve significant savings through a leaderboard or “employee of the month” feature can foster a sense of healthy competition and motivate others to improve. This can be achieved through company-wide emails, newsletters, or dedicated channels on internal communication platforms. This type of reward appeals to social recognition and a sense of belonging.

- Small Bonuses and Perks: Monetary incentives, such as gift cards, small cash bonuses, or extra vacation days, can be offered for achieving specific savings goals or demonstrating exceptional cost-saving efforts. These can be particularly effective for driving immediate results.

- Access to Exclusive Resources: Providing access to premium training materials, early access to new features, or invitations to exclusive events for top performers can be a compelling incentive. This appeals to the desire for personal and professional development.

- Gamified Progress Tracking: Visual representations of progress, such as a progress bar filling up as a user approaches a savings target, can be a strong motivator. This provides immediate feedback and a sense of accomplishment.

Effectiveness of Monetary vs. Non-Monetary Incentives

The choice between monetary and non-monetary incentives depends on the specific goals, target audience, and available budget. Both types have their strengths and weaknesses.

- Monetary Incentives: These can provide immediate gratification and are often effective at driving short-term behavior change. However, they can be expensive to sustain and may not foster long-term intrinsic motivation. Furthermore, the effectiveness of monetary rewards can diminish over time as users become accustomed to them. Consider the following example: a team that consistently exceeds its savings goals receives a small bonus.

Initially, this can boost morale and effort. However, if the bonus becomes expected, its impact diminishes, and removing it can lead to demotivation.

- Non-Monetary Incentives: These include recognition, badges, and opportunities for advancement. They can be more cost-effective and can foster intrinsic motivation, which is more sustainable over time. Non-monetary incentives are particularly effective when they are aligned with the values and interests of the target audience. For example, a FinOps team may value public recognition of their efforts. Providing this recognition, through a team-wide shout-out or award, can be more effective than a small cash bonus.

The most effective programs often incorporate a combination of both monetary and non-monetary incentives. The balance should be adjusted based on performance, feedback, and the overall objectives of the FinOps initiative.

Potential Pitfalls of Incentive Programs and How to Avoid Them

Designing and implementing an effective incentive program requires careful planning to avoid potential pitfalls that can undermine its success.

- Setting Unrealistic Goals: Setting overly ambitious or unattainable savings targets can demotivate users and lead to program abandonment. Ensure that goals are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). For instance, instead of setting a goal to “reduce cloud costs significantly,” a SMART goal would be “reduce cloud costs by 10% within the next quarter by identifying and deleting unused resources.”

- Focusing Solely on Short-Term Gains: Over-reliance on short-term incentives can lead to unsustainable behaviors. Design the program to encourage long-term cost-consciousness by incorporating rewards for consistent performance and continuous improvement.

- Ignoring Unintended Consequences: Incentive programs can sometimes lead to unintended consequences, such as gaming the system or focusing on the wrong metrics. Carefully consider the potential side effects of any incentive and monitor the program’s impact to identify and address any issues. For example, if a reward is given for the

-highest* cost reduction, it could incentivize the reduction of essential resources to achieve a short-term gain, which is detrimental to long-term performance. - Lack of Transparency: Ensure that the program’s rules, rewards, and evaluation criteria are transparent and easily understood by all participants. This builds trust and fairness. Clearly communicate how savings are calculated and how rewards are earned.

- Ignoring Feedback: Regularly collect feedback from participants to identify areas for improvement and ensure the program remains relevant and engaging. Conduct surveys, hold focus groups, and actively solicit suggestions.

By carefully considering these potential pitfalls and implementing appropriate safeguards, organizations can create incentive programs that effectively motivate users, drive cost savings, and foster a culture of financial responsibility.

Implementing Gamification in a FinOps Platform

Integrating gamification into a FinOps platform requires careful planning and execution to ensure a seamless user experience and achieve the desired cost-saving outcomes. This section Artikels the technical steps, user interface considerations, and a sample user journey to guide the implementation process.

Technical Steps for Integration

The technical implementation involves several key steps to embed gamification features into an existing FinOps platform. These steps should be performed systematically to ensure data integrity and user experience are maintained.

The process usually involves the following steps:

- Identify Integration Points: Determine the specific areas within the FinOps platform where gamification elements will be integrated. This includes cost dashboards, resource allocation views, and reporting sections.

- Choose a Gamification Framework/Library: Select a suitable framework or library to streamline the development process. Options range from custom-built solutions to third-party platforms. Popular choices include libraries like Leaderboard.js for leaderboards or specific API integrations for point systems.

- Design Database Schema: Create or modify the database schema to store gamification-related data. This includes user points, badges earned, leaderboard rankings, and progress toward cost-saving goals. The schema must be designed to handle large amounts of data and frequent updates.

- Develop API Endpoints: Build API endpoints to handle gamification logic. These APIs will be responsible for:

- Updating user scores based on actions (e.g., identifying cost-saving opportunities).

- Awarding badges or achievements.

- Retrieving leaderboard data.

- Triggering notifications and alerts.

- Implement User Interface (UI) Components: Develop the UI components to display gamification elements. This includes:

- Leaderboards: Display user rankings based on cost savings.

- Progress Bars: Show users’ progress towards their cost-saving goals.

- Badges/Achievements: Display earned badges and achievements.

- Notifications: Alert users about new achievements or opportunities.

- Integrate with Existing Data Sources: Connect the gamification components to the FinOps platform’s existing data sources, such as cloud provider APIs, cost management tools, and resource utilization metrics. Data synchronization is crucial for accurate scoring and progress tracking.

- Test and Deploy: Thoroughly test all gamification features to ensure they function correctly and do not impact the performance of the FinOps platform. Deploy the updated platform to a production environment after successful testing.

- Monitor and Iterate: Continuously monitor the performance of the gamification features and gather user feedback. Iterate on the design and implementation based on data and user feedback to optimize the user experience and effectiveness of the gamification elements.

Organizing the User Interface for a Gamified FinOps Dashboard

Organizing the user interface is crucial for creating an engaging and intuitive gamified FinOps dashboard. A well-designed UI helps users easily understand their progress, track their achievements, and stay motivated.

The UI should include the following elements, strategically placed for optimal user engagement:

- Dashboard Overview: Provide a central dashboard that offers a high-level view of the user’s progress and achievements. This should include:

- A personalized user profile with their avatar, current points, and leaderboard position.

- A summary of key performance indicators (KPIs) related to cost savings.

- Quick access to their badges and achievements.

- Leaderboard: Display a leaderboard that shows user rankings based on their cost-saving performance.

- Allow users to filter and sort the leaderboard based on different criteria (e.g., team, department).

- Provide clear visibility of their position and the progress of other users.

- Progress Tracking: Implement progress bars and visual indicators to track user progress towards their cost-saving goals.

- Clearly display the target cost savings and the user’s current progress.

- Provide visual feedback when the user achieves milestones.

- Achievements and Badges: Implement a system for awarding achievements and badges to users.

- Show the badges users have earned, with descriptions and the criteria for earning them.

- Provide a dedicated section for viewing all available achievements and their requirements.

- Notifications and Alerts: Integrate a notification system to keep users informed about their progress and any new opportunities.

- Send notifications for new achievements, leaderboard updates, and cost-saving recommendations.

- Provide clear and concise alerts to guide users toward actions that will earn them points or badges.

- Actionable Insights: Integrate actionable insights directly into the dashboard.

- Suggest specific actions users can take to save costs.

- Provide links to relevant resources and tutorials.

- Allow users to quickly execute cost-saving actions directly from the dashboard.

User Journey Flowchart: Achieving Cost-Saving Goals

A well-defined user journey helps guide users from their initial interaction with the gamified FinOps platform to achieving their cost-saving goals. The flowchart below illustrates a typical user journey.

This flowchart represents the process from the user’s initial interaction with the gamified FinOps platform to achieving their cost-saving goals.

Start: User logs into the FinOps platform.

- View Dashboard: User sees the gamified dashboard. The dashboard displays the user’s current points, leaderboard position, and progress towards their cost-saving goals.

- Explore Cost-Saving Opportunities: The user explores cost-saving recommendations and opportunities presented on the dashboard.

- Take Action: The user takes action based on the recommendations (e.g., right-sizing instances, deleting unused resources).

- System Tracks Actions: The system tracks the user’s actions and calculates the associated cost savings.

- Earn Points: The user earns points based on the actions they take and the cost savings achieved.

- Progress Tracking: The user’s progress towards their cost-saving goals is updated on the dashboard via progress bars and other visual indicators.

- Achieve Milestones/Badges: The user achieves milestones and earns badges based on their progress.

- Leaderboard Updates: The user’s position on the leaderboard is updated.

- Receive Notifications: The user receives notifications for new achievements, leaderboard updates, and other relevant information.

- Continuous Engagement: The user continues to engage with the platform, taking actions to save costs and earn points.

- Reach Cost-Saving Goal: The user successfully achieves their cost-saving goal.

- End: User celebrates achievement and the cycle continues with new goals.

Examples of Gamified FinOps Initiatives

Successfully integrating gamification into FinOps requires practical examples and demonstrable results. By examining real-world applications, we can understand how companies leverage gamified elements to drive cost savings and improve cloud efficiency. These case studies highlight the diverse approaches and impactful outcomes achieved through strategic gamification.

Case Studies of Successful Gamified FinOps Implementations

Several organizations have pioneered the use of gamification within their FinOps strategies, achieving significant results. These case studies provide valuable insights into how different companies have tailored their gamification approaches to their specific cloud environments and business objectives.

- Company A: Cloud Optimization Challenge. This technology company, experiencing escalating cloud costs, implemented a “Cloud Optimization Challenge.” Employees were assigned quests to identify and eliminate wasted cloud resources, such as unused instances and over-provisioned storage. Progress was tracked through a leaderboard, and top performers received public recognition and small monetary rewards. The result was a 15% reduction in monthly cloud spending within the first quarter.

- Company B: FinOps Champion Program. A large e-commerce platform created a “FinOps Champion Program.” Employees across different teams were nominated as FinOps champions. These champions received specialized training and were tasked with educating their colleagues on cost optimization best practices. They participated in monthly challenges, such as identifying the most cost-effective storage solutions. The program fostered a culture of cost awareness, leading to a 10% reduction in cloud waste and a 5% improvement in overall resource utilization.

- Company C: Cost Savings Quest for Engineering Teams. This software development company introduced a “Cost Savings Quest” for its engineering teams. Each team was given a target cost for their cloud resources and rewarded for meeting or exceeding the target. Teams earned points by implementing cost-saving measures like rightsizing instances and optimizing database configurations. The quest fostered healthy competition, resulting in a 12% decrease in cloud infrastructure costs.

Specific Gamified Features Used in FinOps

The success of gamified FinOps initiatives hinges on the strategic deployment of engaging elements. Various gamified features can be integrated into FinOps platforms to incentivize cost-conscious behavior and encourage active participation.

- Challenges. Challenges involve setting specific, measurable, achievable, relevant, and time-bound (SMART) goals for cost reduction. For instance, a challenge might be to reduce the cost of a particular service by a certain percentage within a given timeframe. These challenges foster a sense of competition and encourage users to actively seek cost-saving opportunities.

- Quests. Quests are structured tasks that guide users through specific cost optimization activities. An example of a quest could be “Identify and rightsize all over-provisioned virtual machines.” Completing quests earns users points or rewards, motivating them to learn and implement cost-saving practices.

- Leaderboards. Leaderboards display the performance of individuals or teams, creating a sense of competition and encouraging users to strive for better results. Leaderboards can be based on metrics such as cost savings achieved, resources optimized, or challenges completed.

- Levels. Levels represent a progression system where users advance based on their FinOps achievements. As users accumulate points or complete quests, they level up, unlocking new features or rewards. This provides a sense of accomplishment and encourages continuous engagement with FinOps practices.

- Badges. Badges are visual representations of accomplishments or skills related to FinOps. They are awarded for specific achievements, such as successfully identifying and eliminating wasted resources or optimizing a particular service. Badges provide recognition and motivate users to learn and excel in various FinOps areas.

Outcomes and Results Achieved Through Gamified FinOps

The implementation of gamification in FinOps has yielded substantial results for organizations across various industries. The primary outcome is a demonstrable reduction in cloud spending, but other benefits include improved resource utilization and enhanced cost awareness.

- Cost Savings. The most direct result of gamified FinOps is a reduction in cloud spending. Companies have reported significant cost savings through the identification and elimination of waste, optimization of resource utilization, and adoption of cost-effective cloud services. These savings can be quantified and tracked, providing a clear return on investment for the gamification efforts. For instance, a financial services firm using a gamified FinOps platform reported a 20% reduction in cloud costs within six months.

- Improved Resource Utilization. Gamification encourages users to optimize their cloud resources, leading to improved utilization rates. This includes rightsizing instances, eliminating idle resources, and adopting more efficient storage solutions. Improved resource utilization translates to lower cloud costs and increased operational efficiency.

- Enhanced Cost Awareness. Gamification fosters a culture of cost awareness among employees. By providing visibility into cloud spending and rewarding cost-conscious behavior, gamification helps employees understand the financial implications of their cloud resource usage. This increased awareness leads to more informed decision-making and proactive cost management.

- Increased Engagement and Participation. Gamified FinOps initiatives often result in higher engagement and participation from employees. The competitive and rewarding nature of gamification motivates users to actively participate in cost optimization efforts, leading to improved outcomes.

Measuring the Effectiveness of Gamification

Effectively measuring the impact of gamification within FinOps is crucial for determining its success and making data-driven improvements. A robust measurement strategy ensures that initiatives are achieving their intended goals, providing valuable insights into user behavior, and ultimately contributing to significant cost savings. This section details key performance indicators (KPIs), user engagement metrics, and feedback mechanisms necessary for a comprehensive evaluation of gamified FinOps programs.

Key Performance Indicators (KPIs) for Gamified FinOps

Establishing well-defined KPIs is essential for tracking the progress and effectiveness of gamified FinOps initiatives. These metrics provide quantifiable data to assess whether the implemented gamification strategies are positively influencing cost optimization behaviors. The following KPIs should be monitored:

- Cost Savings: This is the most fundamental KPI, directly measuring the financial impact of the gamified FinOps program. It can be tracked in several ways:

- Total Cost Reduction: The overall decrease in cloud spending compared to a baseline period (e.g., the month before gamification implementation).

- Cost Avoidance: Identifying and quantifying costs that were prevented through user actions (e.g., unused resources identified and removed).

- Cost per Unit of Work: Analyzing how costs change relative to the amount of work being done.

- Resource Utilization: Measures how efficiently cloud resources are being used. Tracking resource utilization is essential for identifying opportunities for optimization.

- CPU Utilization: The percentage of CPU capacity used by virtual machines.

- Storage Utilization: The percentage of storage capacity used.

- Idle Resources: The amount of unused resources (e.g., virtual machines, storage) that are still incurring costs.

- User Engagement: Measures how actively users are participating in the gamified elements. This includes tracking:

- Active Users: The number of users actively participating in the gamified features (e.g., using dashboards, completing challenges).

- Challenge Completion Rate: The percentage of challenges or tasks completed by users.

- Leaderboard Participation: The number of users who actively participate in leaderboards.

- Frequency of Interactions: The number of times users interact with gamified features (e.g., logging in, viewing dashboards, completing tasks).

- Adoption Rate: This indicates how quickly users adopt and embrace the gamified features.

- Percentage of Users Using Gamified Features: The proportion of users within the target audience who are actively using the gamified elements.

- Time to Adoption: The time it takes for users to start using the gamified features after their launch.

- Compliance with Cost Optimization Recommendations: Measures the extent to which users are following the cost optimization recommendations provided through the gamified platform.

- Number of Recommendations Implemented: The number of cost-saving recommendations that users have taken action on.

- Percentage of Recommendations Implemented: The proportion of all recommendations that have been implemented.

- Time to Resolution: Measures the speed at which users address and resolve cost-related issues.

- Average Time to Resolve a Cost Anomaly: The average time it takes for users to address cost anomalies.

- Average Time to Implement a Cost-Saving Recommendation: The average time it takes to implement a cost-saving recommendation.

Measuring User Engagement with Gamification Features

Understanding user engagement is crucial to assess the effectiveness of the gamified elements and ensure they are capturing user interest. A detailed approach to measuring user engagement involves a combination of quantitative and qualitative methods:

- Quantitative Metrics:

- Login Frequency: Tracking how often users log into the FinOps platform and interact with the gamified features. A higher login frequency indicates greater engagement.

- Feature Usage: Monitoring which gamified features are most popular and frequently used (e.g., leaderboards, challenges, dashboards).

- Challenge Completion Rates: Measuring the percentage of users completing specific challenges or tasks. High completion rates suggest the challenges are engaging and relevant.

- Time Spent on Features: Tracking the amount of time users spend interacting with specific gamified elements. More time spent indicates greater interest and engagement.

- Clicks and Interactions: Analyzing the number of clicks, actions, and interactions within the gamified platform. This helps identify which elements are most engaging.

- Qualitative Metrics:

- Surveys: Distributing surveys to users to gather feedback on their experience with the gamified features. Surveys can provide insights into user satisfaction, motivation, and areas for improvement.

- User Interviews: Conducting interviews with users to gather in-depth feedback on their experiences, challenges, and suggestions.

- Focus Groups: Organizing focus groups to discuss the gamified features and gather feedback from multiple users simultaneously.

- A/B Testing: Implementing A/B testing to compare different versions of gamified elements (e.g., different challenge formats, reward systems) and determine which ones perform best.

- Example: Imagine a gamified FinOps platform that includes a leaderboard and cost-saving challenges. To measure engagement, you might track the number of active users on the leaderboard, the percentage of users completing the weekly cost-saving challenge, and the average time spent interacting with the platform’s cost analysis dashboard. A survey could then be used to gauge user satisfaction with the leaderboard and challenges.

Process for Gathering User Feedback to Improve Gamification

Collecting and acting on user feedback is an ongoing process that drives continuous improvement in the gamified FinOps experience. A well-defined process ensures that user insights are captured, analyzed, and used to enhance the effectiveness of the gamified features. The following steps are critical:

- Establish Feedback Channels: Provide multiple channels for users to provide feedback.

- In-App Feedback Forms: Integrate feedback forms directly into the FinOps platform. This makes it easy for users to provide feedback while using the system.

- Surveys: Regularly distribute surveys to users to gather feedback on their experience with the gamified features.

- Dedicated Feedback Email: Create a dedicated email address where users can submit their feedback and suggestions.

- User Forums: Establish user forums or discussion boards where users can share their experiences and ideas with each other.

- Collect and Organize Feedback: Centralize the collection of user feedback and organize it for analysis.

- Feedback Database: Use a database or spreadsheet to store all feedback collected from various channels.

- Categorization: Categorize feedback based on topics (e.g., ease of use, feature requests, technical issues, rewards).

- Sentiment Analysis: Analyze the sentiment of the feedback (positive, negative, neutral) to understand user perceptions.

- Analyze Feedback: Analyze the collected feedback to identify trends and areas for improvement.

- Identify Common Themes: Look for recurring themes or patterns in the feedback.

- Prioritize Issues: Prioritize issues based on their frequency, impact, and user importance.

- Analyze User Behavior: Correlate feedback with user behavior data to understand the impact of the gamified features.

- Implement Improvements: Take action based on the feedback analysis.

- Prioritize Actionable Items: Focus on addressing the most critical and impactful issues.

- Develop Solutions: Design and implement solutions to address the identified issues.

- Iterate and Test: Continuously iterate and test the gamified features based on user feedback.

- Communicate Changes: Keep users informed about the changes made based on their feedback.

- Release Notes: Publish release notes detailing the changes made and the reasons behind them.

- User Announcements: Make announcements within the platform to highlight new features and improvements.

- Feedback Acknowledgement: Acknowledge user feedback and thank users for their contributions.

- Example: A gamified FinOps platform receives feedback through an in-app feedback form, reporting that users find the challenges too difficult. The feedback is categorized and analyzed, revealing a trend. The team then adjusts the challenge difficulty and complexity based on the analysis. The team then announces the changes in the platform, letting users know that their feedback was taken into consideration.

Challenges and Considerations in Gamification

Implementing gamification in FinOps, while promising, is not without its hurdles. Careful consideration of potential pitfalls and proactive mitigation strategies are crucial for success. Understanding the inherent challenges and developing robust solutions ensures the gamified initiatives drive genuine savings and foster a positive user experience.

Potential User Resistance

User resistance can significantly hinder the adoption and effectiveness of gamified FinOps programs. Resistance often stems from several factors, and addressing these proactively is paramount.

- Skepticism and Mistrust: Users might be skeptical about the program’s genuine intentions, viewing it as a superficial attempt to control spending rather than a tool for empowerment. This can be mitigated by transparent communication about the program’s goals, how savings will be utilized (e.g., reinvestment in innovation), and clear explanations of the underlying logic.

- Lack of Understanding: If the gamification mechanics are complex or poorly explained, users may struggle to understand how they can participate or how their actions contribute to savings. Simple, intuitive designs, coupled with clear tutorials and regular updates, are essential.

- Fear of Being Monitored: Some users may feel uncomfortable being constantly monitored, perceiving it as a lack of trust. It’s important to emphasize the collaborative aspect of FinOps and highlight how gamification provides insights and empowers them to make informed decisions. Privacy considerations must be addressed explicitly.

- Perceived Inequity: If the rewards or scoring systems are perceived as unfair or biased, users may feel demotivated. Ensure the scoring system is objective, transparent, and considers different roles and responsibilities within the organization.

Misaligned Incentives and Unintended Consequences

Poorly designed gamification can lead to misaligned incentives and unintended consequences, undermining the program’s objectives.

- “Gaming the System”: Users may attempt to manipulate the system to gain rewards without contributing to genuine cost savings. For example, someone might be incentivized to shut down resources without considering their business impact.

- Focus on Metrics Over Outcomes: Overemphasis on specific metrics can lead to users prioritizing those metrics at the expense of overall cost optimization. For instance, if the focus is solely on cloud resource utilization rates, teams might optimize for this even if it increases overall operational complexity or reduces performance.

- Short-Term Focus: Rewards systems based solely on immediate savings can discourage long-term strategic thinking about cost optimization. It is important to balance immediate gains with sustainable practices.

- Exclusion of Key Stakeholders: Failing to involve all relevant stakeholders in the design and implementation can lead to a program that doesn’t reflect the reality of how costs are incurred and managed.

Strategies for Mitigation

To overcome these challenges and ensure successful gamification in FinOps, consider the following strategies.

- Comprehensive User Education: Provide extensive training and educational materials to ensure users understand the program’s goals, mechanics, and their roles. This should include examples, case studies, and regular updates.

- Iterative Design and Feedback: Continuously gather feedback from users and iterate on the program’s design. This helps to identify and address any issues or concerns proactively.

- Balanced Metrics and Holistic Approach: Focus on a balanced set of metrics that consider both short-term and long-term goals. Avoid solely prioritizing individual metrics over the overall cost optimization strategy.

- Clear Rules and Guidelines: Establish clear rules and guidelines to prevent “gaming the system.” These rules should be transparent and consistently enforced.

- Transparency and Communication: Maintain open communication about the program’s progress, successes, and challenges. This builds trust and encourages user participation.

- Incentivize Collaboration and Knowledge Sharing: Encourage collaboration and knowledge sharing among users by incorporating team-based challenges and rewards.

Preventing “Gaming the System”

To maintain the integrity of the gamification program, implement the following measures to prevent users from “gaming the system.”

- Auditing and Monitoring: Implement robust auditing and monitoring systems to detect any unusual activity or attempts to manipulate the system. This should include regular reviews of cost data and user behavior.

- Contextualized Metrics: Ensure metrics are contextualized and take into account business needs and usage patterns. Avoid overly simplistic metrics that can be easily manipulated.

- Multi-faceted Scoring Systems: Use multi-faceted scoring systems that consider a range of factors, not just immediate cost savings. For example, include metrics related to resource efficiency, security, and performance.

- Periodic Review and Adjustment: Regularly review the gamification program’s design and mechanics to identify any potential loopholes or areas for improvement. Adjust the program as needed to maintain its effectiveness.

- Penalties for Abuse: Establish clear penalties for users who attempt to game the system. This can deter malicious behavior and maintain the integrity of the program.

Future Trends and Innovations in Gamified FinOps

The evolution of gamified FinOps is poised for significant advancements, driven by emerging technologies and a deeper understanding of user behavior. These innovations promise to make cost optimization more engaging, effective, and aligned with organizational goals. The following sections will explore how AI, machine learning, and other technologies can shape the future of gamified FinOps, along with potential new features and a vision for its ongoing development.

Leveraging AI and Machine Learning for Enhanced Gamification

AI and machine learning (ML) are set to revolutionize gamified FinOps by providing more personalized experiences, automating tasks, and offering deeper insights. Their capabilities allow for dynamic adjustments to gamification elements, leading to increased engagement and improved cost savings.

- Personalized Recommendations: AI can analyze user spending patterns and identify areas for optimization. Based on this analysis, the system can provide tailored recommendations, challenges, and rewards. For example, if a user frequently overspends on a specific service, the system could suggest a challenge to reduce spending on that service by a certain percentage, offering points or badges for success.

- Automated Anomaly Detection: ML algorithms can detect unusual spending patterns and flag them for immediate attention. This allows for rapid intervention and prevents unexpected cost overruns. A visual representation of a sudden spike in spending, perhaps due to a misconfigured instance, would be immediately flagged within the gamified platform, with suggestions for correction and a leaderboard impact assessment.

- Predictive Analytics for Cost Optimization: ML models can forecast future spending based on historical data and current usage. This enables proactive cost optimization strategies and helps users plan their resource allocation more effectively. Users could receive alerts and participate in challenges to reduce projected costs, such as identifying and right-sizing underutilized resources before they contribute to future expenses.

- Dynamic Difficulty Adjustment: The AI can dynamically adjust the difficulty of challenges and the value of rewards based on user performance and the overall cost landscape. This ensures that the gamification remains engaging and relevant over time, avoiding the potential for challenges to become too easy or too difficult. For instance, as a user consistently meets cost-saving targets, the AI might introduce more complex challenges or offer more valuable rewards.

Potential New Gamification Features for the Future

The possibilities for gamification in FinOps are vast, with new features continually emerging to enhance user engagement and drive cost-saving behaviors. These features can be integrated into existing FinOps platforms to create a more compelling and effective experience.

- Interactive Cost Simulations: Users could interact with simulations that show the impact of their resource allocation decisions on costs. They could adjust configurations, scale resources, and see in real-time how these changes affect their spending, visualized through graphs and dashboards, leading to informed decision-making.

- Team-Based Challenges and Competitions: Implement team-based challenges where users collaborate to achieve shared cost-saving goals. This promotes teamwork, knowledge sharing, and a sense of collective responsibility. Teams could compete on leaderboards to see who can reduce their combined costs the most.

- Augmented Reality (AR) Dashboards: AR could overlay cost data and optimization recommendations onto real-world views of infrastructure. For example, a user could point their phone at a server rack and see real-time cost information, resource utilization metrics, and recommendations for right-sizing, visualized directly on the physical infrastructure.

- Personalized Cost-Saving Journeys: Create personalized learning paths and challenges tailored to each user’s role and expertise. This could involve a series of challenges, each building on the previous one, to guide users through the process of cost optimization, earning badges and points as they progress.

- Integration with Social Media: Allow users to share their achievements and progress on social media platforms. This fosters a sense of community and encourages friendly competition, and the platform could provide options for users to broadcast their achievements, encouraging peer-to-peer knowledge transfer.

Vision for the Evolution of Gamification within the FinOps Landscape

The future of gamified FinOps is one of seamless integration, proactive optimization, and personalized experiences. It will transform how organizations approach cloud cost management, shifting from a reactive to a proactive and engaging process.

- Proactive Cost Management: Gamification will shift from tracking and reporting costs to proactively identifying and mitigating potential cost overruns before they occur. AI-powered predictive analytics will play a key role in this shift.

- Personalized Learning and Development: The FinOps platform will become a dynamic learning environment, providing users with personalized training and development opportunities. Users can learn the impact of their decisions.

- Data-Driven Decision Making: Gamified elements will surface key data and insights in a way that makes it easy for users to understand and act upon. Real-time dashboards and interactive visualizations will be the norm.

- Integration with DevOps Workflows: Gamification will be integrated into DevOps workflows, making cost optimization a natural part of the development lifecycle. This integration will foster a culture of cost awareness and responsibility.

- Continuous Improvement and Adaptation: Gamified FinOps platforms will continuously adapt and evolve based on user feedback and performance data. The platform will analyze user engagement and optimize challenges and rewards for maximum impact.

Final Thoughts

In conclusion, gamification in FinOps presents a compelling approach to cultivate a cost-conscious culture and achieve significant cloud savings. By thoughtfully designing gamified elements, tracking progress, and providing meaningful rewards, organizations can empower their teams to make informed decisions about cloud spending. While challenges may arise, the potential for improved efficiency, increased engagement, and substantial cost reductions makes gamification a valuable strategy in the ever-evolving landscape of cloud financial management.

The future of FinOps likely includes even more innovative gamified approaches, driven by AI and other emerging technologies, further enhancing its effectiveness and reach.

User Queries

What is the primary goal of gamification in FinOps?

The primary goal is to motivate and engage individuals and teams to adopt cost-saving behaviors, leading to reduced cloud spending and improved financial efficiency.

How does gamification encourage cost savings in FinOps?

Gamification encourages cost savings by using game-design elements like points, leaderboards, badges, and rewards to make cloud cost management more engaging and to recognize and incentivize cost-saving actions.

What are some examples of rewards used in gamified FinOps?

Rewards can include virtual badges, public recognition (e.g., team shout-outs), small bonuses, or even opportunities for professional development.

What are the potential challenges of implementing gamification in FinOps?

Potential challenges include user resistance, the risk of “gaming the system,” and ensuring that incentives are aligned with the overall FinOps goals and not promoting counterproductive behaviors.

How can organizations measure the success of gamified FinOps initiatives?

Success can be measured through key performance indicators (KPIs) such as cloud spending reduction, user engagement with gamification features, and positive feedback from users.