Understanding “what are cost categories for grouping spend” is crucial for businesses aiming to improve financial control and strategic decision-making. This fundamental concept involves organizing all expenditures into logical groups, providing a clearer picture of where money is being spent and how efficiently resources are being utilized. From simple categorizations to complex analyses, the way a company structures its cost categories directly impacts its ability to manage expenses, assess profitability, and ultimately, achieve its financial goals.

This guide delves into the intricacies of cost categories, exploring various types such as direct versus indirect costs, and variable versus fixed costs. We’ll examine how these categories are applied across different industries, from manufacturing to services, and how they influence financial reporting. Furthermore, we’ll investigate advanced methods like activity-based costing and the role of technology in streamlining cost management.

By mastering these principles, businesses can gain valuable insights into their financial performance and make informed decisions to drive sustainable growth.

Overview of Cost Categories

Grouping spend into cost categories is a fundamental practice in financial management, offering businesses a structured way to understand and control their expenses. By classifying expenditures, organizations gain valuable insights into where their money is being spent, enabling informed decision-making and strategic resource allocation. This process transforms raw financial data into actionable information, fostering improved financial performance and operational efficiency.

Fundamental Purpose of Grouping Spend

The primary purpose of categorizing spend is to provide a clear and organized view of a company’s financial activities. This clarity is essential for effective budgeting, forecasting, and cost control. Understanding the different types of costs allows businesses to:

- Analyze Profitability: Identify the costs associated with specific products, services, or departments to determine their profitability. This analysis informs pricing strategies and resource allocation decisions.

- Improve Budgeting and Forecasting: Create more accurate budgets and forecasts by understanding historical spending patterns within each category. This allows for proactive financial planning.

- Control Costs: Monitor spending within each category to identify areas where costs can be reduced or optimized. This promotes efficiency and financial discipline.

- Make Informed Decisions: Support strategic decision-making by providing data-driven insights into cost structures. This facilitates informed investment choices and operational improvements.

- Comply with Regulations: Ensure compliance with accounting standards and reporting requirements by classifying expenses in a standardized manner.

Brief History of Cost Categorization Methods

The evolution of cost categorization methods reflects advancements in accounting practices and business needs. Early methods were relatively simple, but as businesses grew in complexity, more sophisticated approaches emerged.

- Early Accounting Systems (Pre-20th Century): Primarily focused on tracking direct costs (e.g., raw materials, direct labor) for basic inventory valuation and profit calculation. Indirect costs were often lumped together, offering limited analytical detail.

- The Rise of Cost Accounting (Early 20th Century): The Industrial Revolution and mass production spurred the development of more refined cost accounting techniques. Methods like job order costing and process costing emerged to allocate costs more accurately to products or services.

- Activity-Based Costing (ABC) (Late 20th Century): ABC revolutionized cost allocation by focusing on the activities that drive costs. It provides a more granular understanding of how resources are consumed, leading to more accurate cost assignments and improved decision-making. ABC is used by organizations like General Electric and Boeing to manage complex production processes.

- Modern Cost Management Systems (21st Century): Technology, including ERP (Enterprise Resource Planning) systems and cloud-based solutions, has significantly improved cost categorization and analysis. These systems automate data collection, streamline reporting, and enable real-time insights. They facilitate sophisticated cost analysis such as variance analysis and trend analysis.

Benefits of Using Cost Categories for Businesses of Different Sizes

Cost categorization provides significant advantages regardless of a company’s size. The specific benefits may vary, but the core principles remain consistent.

- Small Businesses: Even small businesses benefit from cost categorization by gaining better control over their finances. This allows them to:

- Track expenses effectively, ensuring they don’t exceed their budget.

- Identify areas where they can cut costs, improving profitability.

- Make informed decisions about pricing and resource allocation.

- Medium-Sized Businesses: Medium-sized businesses can leverage cost categories to:

- Gain deeper insights into the profitability of different product lines or departments.

- Improve budgeting and forecasting accuracy, facilitating strategic planning.

- Implement cost-saving initiatives based on detailed expense analysis.

- Large Enterprises: Large enterprises rely on cost categories to:

- Manage complex cost structures across multiple departments and locations.

- Support strategic decision-making related to investments, acquisitions, and market expansion.

- Comply with complex accounting and reporting requirements.

- Utilize advanced cost management techniques like activity-based costing and variance analysis.

Direct vs. Indirect Costs

Understanding the distinction between direct and indirect costs is fundamental to accurate cost accounting and informed decision-making. This categorization allows businesses to better understand where their money is being spent, enabling more effective budgeting, pricing strategies, and profitability analysis. Differentiating between these cost types is crucial for a clear picture of operational efficiency and financial health.

Distinguishing Direct and Indirect Costs

Direct costs are those that can be easily and specifically traced to a particular cost object, such as a product, service, or department. Indirect costs, on the other hand, cannot be directly traced to a specific cost object and are instead allocated based on a predetermined method.For example:

- Direct Costs: Consider a furniture manufacturer. The wood used to build a specific table is a direct cost because the cost of the wood can be directly attributed to that particular table. Similarly, the wages of the carpenters working directly on that table are also a direct cost.

- Indirect Costs: In the same scenario, the rent for the factory where the table is made is an indirect cost. It benefits all products manufactured in the factory, but it cannot be directly traced to a single table. Other examples include factory utilities, the salary of the factory supervisor, and the cost of cleaning supplies.

Allocation Methods for Direct and Indirect Costs

Direct costs are directly assigned to the cost object. Indirect costs require an allocation method to be assigned, which is a systematic way of distributing the cost to the cost objects. The allocation method chosen should be logical and reflect the way the indirect cost is consumed.Here are the different allocation methods:

- Direct Costs: Direct materials are assigned based on the quantity used, while direct labor is assigned based on hours worked or the specific task performed.

- Indirect Costs: Several methods exist for allocating indirect costs, depending on the nature of the cost and the business. Common methods include:

- Activity-Based Costing (ABC): This method assigns costs based on activities. For example, the cost of setting up a machine might be allocated based on the number of setups.

- Plant-Wide Overhead Rate: A single overhead rate is used for the entire factory, often based on direct labor hours or machine hours. This is a simpler method but may not be as accurate.

- Departmental Overhead Rates: Different overhead rates are used for different departments within the factory, providing a more accurate allocation.

Common Examples of Direct and Indirect Costs in a Manufacturing Setting

In a manufacturing setting, the identification of direct and indirect costs is essential for accurate product costing.Examples:

- Direct Costs:

- Direct Materials: Raw materials, such as wood, steel, fabric, and plastic, that become part of the finished product.

- Direct Labor: Wages, salaries, and benefits of employees directly involved in the production process, such as machine operators and assembly workers.

- Indirect Costs:

- Factory Rent: The cost of the building where manufacturing takes place.

- Factory Utilities: Electricity, water, and gas used in the factory.

- Factory Supervisor Salary: The salary of the person managing the factory operations.

- Depreciation of Factory Equipment: The allocation of the cost of machinery over its useful life.

- Factory Insurance: The cost of insuring the factory and its contents.

- Indirect Materials: Consumable supplies used in the factory but not directly part of the finished product, such as cleaning supplies, lubricants for machines, and small tools.

Variable vs. Fixed Costs

Understanding the distinction between variable and fixed costs is crucial for effective cost management and informed decision-making. These two categories form the foundation of cost behavior analysis, which helps businesses predict how their costs will change as production levels fluctuate. This knowledge allows for better budgeting, pricing strategies, and profitability assessments.

Characteristics of Variable and Fixed Costs

Variable and fixed costs behave differently, impacting a company’s financial performance in distinct ways. Recognizing these differences is fundamental to financial planning.

- Variable Costs: These costs change in direct proportion to the level of production or sales. As production increases, variable costs increase, and as production decreases, variable costs decrease. The per-unit cost of a variable cost often remains relatively constant, although this can be influenced by factors such as bulk discounts or supplier price changes. Examples of variable costs include:

- Direct materials: Raw materials used in the production process.

- Direct labor: Wages paid to workers directly involved in production.

- Sales commissions: Payments to salespeople based on sales volume.

- Fixed Costs: These costs remain constant regardless of the level of production or sales within a relevant range. They do not change in response to fluctuations in output. Fixed costs are typically associated with the passage of time or the commitment to resources. Examples of fixed costs include:

- Rent: The cost of leasing a building or equipment.

- Salaries: Salaries of administrative and management personnel.

- Depreciation: The allocation of the cost of an asset over its useful life.

Impact of Production Volume on Variable and Fixed Costs

The relationship between production volume and costs is a critical aspect of cost behavior analysis. Understanding how these costs respond to changes in output helps businesses manage expenses effectively.

- Variable Costs: As production volume increases, total variable costs increase proportionally. If a company produces twice as many units, its total variable costs will roughly double (assuming per-unit costs remain constant). Conversely, when production decreases, total variable costs decrease accordingly. This direct relationship is a key characteristic of variable costs.

- Fixed Costs: Fixed costs, in total, remain constant within a relevant range of production. Whether a company produces 1,000 units or 10,000 units, the total fixed costs (e.g., rent) will likely remain the same. However, the fixed cost per unit decreases as production volume increases. This is because the fixed costs are spread over a larger number of units.

Scenario Illustrating the Impact of Variable and Fixed Costs on Profitability

To illustrate the impact of variable and fixed costs, consider a hypothetical bakery that produces and sells cakes. The bakery’s financial performance will be significantly affected by how it manages its variable and fixed costs.

Assumptions:

- Selling Price per Cake: $25

- Variable Cost per Cake: $10 (Ingredients, packaging, etc.)

- Monthly Fixed Costs: $5,000 (Rent, salaries, utilities)

Scenario 1: Low Production (100 cakes sold)

In this scenario, the bakery is not operating at its full capacity.

Revenue: 100 cakes

– $25/cake = $2,500

Variable Costs: 100 cakes

– $10/cake = $1,000

Fixed Costs: $5,000

Total Costs: $1,000 + $5,000 = $6,000

Profit/Loss: $2,500 – $6,000 = -$3,500 (Loss)

Scenario 2: High Production (500 cakes sold)

The bakery is operating at a higher capacity, spreading the fixed costs over more units.

Revenue: 500 cakes

– $25/cake = $12,500

Variable Costs: 500 cakes

– $10/cake = $5,000

Fixed Costs: $5,000

Total Costs: $5,000 + $5,000 = $10,000

Profit/Loss: $12,500 – $10,000 = $2,500 (Profit)

Analysis:

This scenario clearly demonstrates the impact of variable and fixed costs on profitability. In Scenario 1, the bakery incurs a loss because its revenue is insufficient to cover both variable and fixed costs. The fixed costs remain constant, regardless of the low production volume. In Scenario 2, the bakery achieves a profit. The higher production volume allows the bakery to spread its fixed costs over a larger number of cakes, reducing the per-unit cost and increasing profitability.

This scenario illustrates the importance of managing both variable and fixed costs and understanding their impact on the break-even point.

The break-even point is the level of production where total revenue equals total costs, resulting in neither profit nor loss. It is calculated as Fixed Costs / (Selling Price per Unit – Variable Cost per Unit).

Common Cost Category Structures

Understanding how to structure cost categories is crucial for effective financial management and informed decision-making. The chosen structure significantly impacts the ability to analyze costs, identify areas for improvement, and ultimately, optimize profitability. Various structures exist, each tailored to different business needs and objectives.

Accounting Cost Category Structures

Accounting uses several standardized cost category structures to provide a clear and consistent view of a company’s financial performance. These structures are designed to meet regulatory requirements and facilitate financial reporting.

A primary structure focuses on the classification of expenses by function, which is a widely used method for categorizing costs.

- Cost of Goods Sold (COGS): This category includes all direct costs associated with producing goods or services sold. It encompasses materials, labor, and other direct expenses.

For example, in a bakery, COGS would include the cost of flour, sugar, eggs, labor of bakers, and the cost of packaging materials.

- Selling, General, and Administrative Expenses (SG&A): SG&A covers all operating expenses not directly related to the production of goods or services. This includes marketing and advertising costs, salaries of administrative staff, rent, utilities, and office supplies.

For example, a clothing retailer would include advertising expenses, the salaries of sales associates, and the rent for the retail store.

- Research and Development (R&D): This category includes costs related to developing new products or improving existing ones. It encompasses salaries of R&D personnel, laboratory expenses, and prototyping costs.

For example, a pharmaceutical company would include the costs of clinical trials, research staff salaries, and laboratory equipment.

- Interest Expense: This represents the cost of borrowing money.

For example, this includes interest payments on loans and bonds.

- Income Tax Expense: This reflects the taxes paid on a company’s profits.

For example, this is the amount of income tax the company owes based on its taxable income.

Another common structure is based on the nature of the expense. This categorizes costs based on their inherent characteristics.

- Salaries and Wages: This category includes all compensation paid to employees.

For example, this includes base pay, overtime, and bonuses.

- Rent: This covers the cost of leasing property or equipment.

For example, this includes the monthly rent paid for an office space or a manufacturing facility.

- Utilities: This includes expenses for electricity, water, and other utilities.

For example, this includes the cost of electricity used to power a factory or an office building.

- Depreciation: This reflects the decline in value of assets over time.

For example, this includes the depreciation of machinery, equipment, and buildings.

- Supplies: This includes the cost of materials used in the business.

For example, this includes office supplies, cleaning supplies, and other consumable items.

Cost Categories in the Service Industry

The service industry presents unique cost structures, often focusing on labor, materials, and overhead expenses. These categories help businesses in this sector track profitability and manage resources effectively.

Here are some common cost categories used in the service industry:

- Direct Labor: This includes the wages, salaries, and benefits of employees directly involved in providing the service.

For example, in a consulting firm, this would include the salaries of consultants and project managers.

- Materials and Supplies: This covers the cost of materials and supplies used in delivering the service.

For example, in a landscaping business, this would include the cost of plants, soil, and fertilizer.

- Overhead: This encompasses all indirect costs necessary to run the business.

For example, this includes rent, utilities, insurance, and administrative salaries.

- Marketing and Advertising: This includes the expenses associated with promoting the service.

For example, this includes the cost of online advertising, print materials, and promotional events.

- Travel Expenses: This includes the cost of travel required to deliver the service.

For example, this includes airfare, hotel accommodations, and transportation costs.

- Training and Development: This covers the cost of training employees to deliver the service.

For example, this includes the cost of workshops, online courses, and certifications.

Different Cost Category Structures and Business Needs

The selection of a cost category structure is dependent on the specific needs and objectives of a business. Different structures provide various insights and are appropriate for different purposes.

Consider these examples:

- Profitability Analysis: A business aiming to understand its profitability might use a structure that clearly separates direct and indirect costs. This allows for the calculation of gross profit and net profit margins, providing a clear view of how effectively costs are managed in relation to revenue. For instance, a restaurant would track the cost of ingredients (direct) separately from rent and utilities (indirect) to analyze the profitability of each menu item.

- Cost Control: A company focused on controlling costs might adopt a structure that categorizes expenses by department or function. This allows for the identification of cost drivers and the implementation of cost-saving measures. For example, a manufacturing plant might categorize costs by production line to identify areas where efficiency can be improved.

- Decision-Making: Businesses making strategic decisions often use cost structures that highlight relevant costs. This helps to evaluate the financial implications of various options. For instance, a retail chain considering opening a new store would analyze the projected costs of rent, staffing, and inventory to assess the potential profitability of the new location.

- Regulatory Compliance: Companies must adhere to specific cost structures for regulatory reporting. The specific categories and their definitions are often prescribed by accounting standards or industry regulations. This ensures consistency and comparability across different businesses. For example, publicly traded companies must follow the Generally Accepted Accounting Principles (GAAP) to classify and report their expenses.

Cost Categories in Manufacturing

Manufacturing environments present unique cost categorization challenges due to the complexity of production processes. Understanding these categories is crucial for accurate product costing, effective decision-making, and efficient cost control. The following sections detail the specific cost categories typically found in manufacturing.

Raw Materials, Labor, and Overhead Categorization

Manufacturing costs are broadly classified into three main categories: raw materials, direct labor, and manufacturing overhead. These categories allow for a structured approach to tracking and managing production expenses.

- Raw Materials: These are the basic inputs used in the manufacturing process that are directly traceable to the finished product.

- Direct Materials: These are materials that become an integral part of the finished product and can be easily traced to it. For example, in a furniture factory, direct materials would include wood, screws, and fabric.

- Indirect Materials: These materials are necessary for production but are not easily traceable to specific products or are considered insignificant in value. Examples include cleaning supplies, lubricants for machinery, and small hardware like glue or staples.

- Direct Labor: This encompasses the wages and benefits of employees who directly work on converting raw materials into finished goods.

- Examples include: assembly line workers, machine operators, and welders.

- Direct labor costs are directly tied to the production volume.

- Manufacturing Overhead: This category includes all manufacturing costs other than direct materials and direct labor. It’s an umbrella term covering a wide range of expenses necessary for the production process.

- Indirect Labor: This includes the wages of employees who support the production process but don’t directly work on the product, such as supervisors, maintenance personnel, and quality control inspectors.

- Factory Rent and Utilities: Costs associated with the factory building, including rent, electricity, water, and heating.

- Depreciation of Factory Equipment: The allocation of the cost of factory equipment over its useful life.

- Factory Insurance and Property Taxes: Costs related to insuring the factory and paying property taxes.

- Indirect Materials: (As mentioned earlier)

Overhead Cost Allocation Procedure

Accurately allocating overhead costs is essential for determining the true cost of products. A systematic procedure ensures these costs are distributed appropriately across different products or departments.

- Identify the Cost Pools: Group similar overhead costs together into cost pools. For example, a cost pool could be “Factory Utilities” or “Equipment Depreciation.”

- Select an Allocation Base: Choose a suitable allocation base for each cost pool. An allocation base is a factor that drives the overhead costs. The choice of allocation base depends on the nature of the cost pool and the production process. Common allocation bases include:

- Direct labor hours: Appropriate when overhead costs are driven by labor effort.

- Machine hours: Suitable when production is heavily automated.

- Direct labor cost: Used when overhead costs are correlated with labor expenses.

- Units of production: Suitable when overhead costs vary with the volume of production.

Overhead Rate = (Total Overhead Costs in the Cost Pool) / (Total Activity in the Allocation Base)

For instance, if a factory’s total utility costs (cost pool) are $50,000, and the total machine hours (allocation base) are 10,000 hours, the overhead rate for utilities would be $5 per machine hour ($50,000 / 10,000 hours).

For example, if a product used 2 machine hours, the overhead cost allocated to that product would be $10 (2 hours x $5/hour).

Cost Categories in Service Industries

The service industry presents unique challenges in cost accounting compared to manufacturing. Unlike tangible products, services are often intangible, perishable, and produced and consumed simultaneously. This section will explore the specific cost categories prevalent in service industries, highlighting key differences from manufacturing and examining the treatment of labor costs and cost drivers.

Cost Categories Specific to the Service Industry

Service industries categorize costs based on the nature of the service and the operational processes involved. These categories differ from manufacturing, which focuses on raw materials, direct labor, and manufacturing overhead.

- Labor Costs: This is often the largest cost category in service industries. It encompasses wages, salaries, benefits, and payroll taxes for employees directly involved in service delivery (e.g., nurses in a hospital, consultants in a consulting firm) and support staff.

- Occupancy Costs: These costs include rent or mortgage payments, utilities, property taxes, and maintenance for the physical space where services are provided (e.g., a doctor’s office, a retail store).

- Marketing and Advertising Costs: These costs cover expenses related to promoting and selling services, including advertising campaigns, website development, and sales team salaries.

- Technology and Software Costs: Service businesses heavily rely on technology. This includes software licenses, hardware, IT support, and cloud services.

- Training and Development Costs: Investing in employee skills and knowledge is crucial in service industries. This includes training programs, certifications, and professional development.

- Supplies and Consumables: Although services are intangible, some require supplies. Examples include medical supplies in healthcare, stationery in legal services, or cleaning supplies in hospitality.

- Depreciation and Amortization: These costs relate to the decline in value of assets used in service delivery, such as equipment, furniture, and software.

- Administrative and General Costs: These include expenses related to the overall management of the business, such as accounting, legal fees, insurance, and executive salaries.

Comparison of Labor Costs in Service and Manufacturing

The treatment of labor costs varies significantly between service and manufacturing environments. The nature of labor and its direct link to service delivery or product creation is a key differentiator.

- Manufacturing: Labor costs are categorized as either direct labor (directly involved in producing goods) or indirect labor (supporting production). Direct labor costs are easily traceable to the product and are a significant component of the cost of goods sold (COGS).

- Service: Labor costs are often primarily direct. The service provider is the product. For example, a lawyer’s time is the service, and the lawyer’s salary is a direct labor cost. Indirect labor exists, but its impact is less direct than in manufacturing. For instance, administrative staff support the service delivery but don’t directly provide the service.

- Allocation of Labor Costs: In service industries, allocating labor costs to specific services or projects is crucial for profitability analysis. Time tracking systems and activity-based costing (ABC) are often used to accurately allocate labor costs. In manufacturing, allocating labor costs is typically simpler because the labor is directly associated with the production of goods.

- Impact of Labor Costs on Pricing: Labor costs significantly influence pricing strategies in both sectors. However, the direct relationship between labor and service delivery often leads to a more direct link between labor costs and pricing in service industries. Service businesses frequently use a cost-plus pricing model, where the cost of labor is a primary factor.

Key Drivers of Cost in the Service Industry

Understanding the key drivers of cost is essential for effective cost management in the service industry. Identifying these drivers allows businesses to focus on areas where cost reduction efforts can be most impactful.

- Labor Utilization: The efficiency with which labor resources are used is a significant cost driver. Underutilized staff or inefficient workflows lead to higher labor costs per service delivered.

- Service Volume: The number of services provided directly impacts many cost categories, particularly labor and supplies. Increasing service volume without a corresponding increase in efficiency can drive up costs.

- Customer Acquisition Costs: The costs associated with attracting and retaining customers are a major cost driver. These costs include marketing, advertising, and sales efforts.

- Technology Adoption: The level of technology adoption can significantly impact costs. While technology can improve efficiency, the initial investment and ongoing maintenance can be substantial.

- Employee Training and Turnover: High employee turnover and the associated costs of training new staff are significant cost drivers. Investing in employee development and retention strategies is crucial.

- Operational Efficiency: Streamlining processes and improving operational efficiency can reduce costs. This includes optimizing workflows, reducing waste, and implementing lean management principles.

- Compliance and Regulatory Requirements: Certain service industries are subject to stringent regulations, which can lead to significant compliance costs. Examples include healthcare, finance, and legal services.

Cost Categories and Financial Reporting

Cost categories play a vital role in financial reporting, providing the foundation for understanding a company’s financial performance and position. The accurate classification and allocation of costs are crucial for creating meaningful financial statements that inform decision-making by management, investors, and other stakeholders. Proper cost categorization allows for a clear presentation of profitability, efficiency, and overall financial health.

How Cost Categories are Used in Financial Statements

Cost categories are directly integrated into the preparation of several key financial statements, each providing a different perspective on a company’s financial performance. The correct categorization of costs ensures the accurate reflection of these statements.

- Income Statement: The income statement, also known as the profit and loss (P&L) statement, relies heavily on cost categories.

- Cost of Goods Sold (COGS): This section primarily reflects the direct costs associated with producing goods or services. It includes direct materials, direct labor, and manufacturing overhead. The calculation of COGS directly impacts the gross profit margin.

- Operating Expenses: These expenses are categorized as selling, general, and administrative (SG&A) expenses. They encompass a broad range of costs, such as salaries, rent, utilities, marketing expenses, and depreciation. Properly categorizing these expenses is essential for calculating operating income and net income.

- Balance Sheet: While the balance sheet primarily focuses on assets, liabilities, and equity, cost categories influence the valuation of inventory.

- Inventory Valuation: The cost of inventory, which is an asset, is determined by the costs incurred in its production or acquisition. The method used to value inventory (e.g., FIFO, LIFO, weighted-average) influences the cost of goods sold and the reported value of inventory on the balance sheet.

- Statement of Cash Flows: While not directly using cost categories in the same way as the income statement, the statement of cash flows is affected by the timing of cost payments. Operating activities, which are a key component of this statement, are influenced by the cash inflows and outflows related to costs, such as payments to suppliers and employees.

How Different Cost Category Structures Affect Profitability Calculations

The way costs are categorized and allocated significantly impacts the calculation of profitability metrics. Different cost structures provide varying insights into a company’s financial performance.

- Gross Profit Margin: This metric, calculated as (Revenue – Cost of Goods Sold) / Revenue, reveals the profitability of core operations before considering operating expenses.

- A higher gross profit margin indicates greater efficiency in production or service delivery. For example, a manufacturing company with a well-controlled COGS, resulting from effective cost control over direct materials and labor, will likely have a higher gross profit margin than a competitor with less efficient production processes.

- Operating Profit Margin: Calculated as (Operating Income / Revenue), this metric assesses profitability after considering operating expenses.

- It provides insight into the efficiency of a company’s operations, excluding interest and taxes. A company with a high operating profit margin demonstrates effective management of its selling, general, and administrative expenses.

- Net Profit Margin: This is the most comprehensive profitability metric, calculated as (Net Income / Revenue).

- It reflects the overall profitability of the company after considering all expenses, including interest and taxes. A high net profit margin suggests strong overall financial performance.

- Impact of Cost Allocation: The methods used to allocate indirect costs, such as overhead, can significantly affect profitability.

- For example, if a company inaccurately allocates overhead costs to a product line, it can distort the perceived profitability of that line, potentially leading to poor pricing or investment decisions. Accurate cost allocation is crucial for informed decision-making.

Relationship Between Cost Categories and Financial Ratios

The following table illustrates the relationship between cost categories and financial ratios. It is a simple example and may need to be expanded upon based on industry and the specific company.

| Cost Category | Financial Ratio | Formula | Impact of Increased Cost (All else equal) |

|---|---|---|---|

| Direct Materials | Gross Profit Margin | (Revenue - COGS) / Revenue | Decreases Gross Profit Margin |

| Direct Labor | Gross Profit Margin | (Revenue - COGS) / Revenue | Decreases Gross Profit Margin |

| Manufacturing Overhead | Gross Profit Margin | (Revenue - COGS) / Revenue | Decreases Gross Profit Margin |

| Selling Expenses | Operating Profit Margin | Operating Income / Revenue | Decreases Operating Profit Margin |

| Administrative Expenses | Operating Profit Margin | Operating Income / Revenue | Decreases Operating Profit Margin |

| Cost of Goods Sold | Inventory Turnover Ratio | COGS / Average Inventory | May increase or decrease the ratio depending on how the increase affects the Average Inventory level. |

Advanced Cost Category Grouping Methods

Advanced cost category grouping methods provide sophisticated approaches to analyzing and managing costs, going beyond basic classifications. These methods enable a more granular understanding of cost drivers and enhance decision-making capabilities. They help organizations allocate costs more accurately, identify areas for improvement, and optimize resource allocation.

Activity-Based Costing (ABC) and Cost Categories

Activity-Based Costing (ABC) is a method that assigns overhead costs to products or services based on the activities they require. It provides a more accurate allocation of indirect costs compared to traditional methods. ABC directly relates costs to the activities that consume resources, leading to a clearer understanding of cost drivers. This contrasts with traditional costing, which often relies on volume-based allocation methods, such as direct labor hours or machine hours, which may not accurately reflect the true cost of activities.

- Defining Activities: The first step involves identifying the activities performed within an organization. Examples include order processing, machine setup, and quality inspection.

- Assigning Costs to Activities: Costs are then assigned to these activities. This includes both direct and indirect costs, such as salaries, rent, and utilities.

- Identifying Cost Drivers: Cost drivers are the factors that cause the cost of an activity to change. Examples include the number of orders processed, the number of setups, or the number of inspections.

- Calculating Activity Rates: The cost of each activity is divided by its cost driver to determine an activity rate.

Activity Rate = Total Cost of Activity / Total Activity Driver Volume

- Allocating Costs to Products or Services: Finally, the activity rates are used to allocate costs to products or services based on their consumption of each activity.

ABC enhances cost category analysis by providing a more detailed breakdown of overhead costs. For example, instead of lumping all manufacturing overhead into a single category, ABC allows for the creation of cost categories for specific activities, such as machine maintenance, materials handling, and quality control. This level of detail enables better cost control and more informed pricing decisions. A company using ABC can pinpoint the activities that drive costs and focus on improving the efficiency of those activities.

For instance, if the cost of machine setups is high, the company might invest in training or new equipment to reduce setup time and cost.

Using Cost Categories in Budgeting

Cost categories are essential for creating effective budgets. They provide a framework for estimating and tracking expenses. A well-structured budget, organized by cost categories, enables organizations to monitor spending, identify variances, and make informed financial decisions.Consider a manufacturing company that produces widgets. The company’s budget might include the following cost categories:

- Direct Materials: This category includes the cost of raw materials used in the production of widgets, such as plastic, metal, and electronic components. The budget would forecast the quantity of each material needed and its cost.

- Direct Labor: This category includes the wages and benefits of employees directly involved in the production of widgets. The budget would forecast the number of labor hours required and the labor rate.

- Manufacturing Overhead: This category includes all other costs associated with manufacturing, such as rent, utilities, depreciation, and indirect labor. The budget would allocate these costs based on appropriate cost drivers.

- Selling, General, and Administrative (SG&A) Expenses: This category includes all costs associated with selling the widgets and running the company, such as salaries of sales and administrative staff, marketing expenses, and office supplies.

The budgeting process involves several steps:

- Forecasting Sales: The company forecasts the number of widgets it expects to sell during the budget period. This forecast drives the estimates for other cost categories.

- Estimating Production Needs: Based on the sales forecast, the company estimates the number of widgets it needs to produce. This determines the required quantities of direct materials and direct labor hours.

- Calculating Cost Estimates: Using historical data, industry benchmarks, and other relevant information, the company estimates the costs for each cost category. For example, the cost of direct materials is calculated by multiplying the quantity needed by the unit cost.

- Creating the Budget: The company creates a budget that summarizes the estimated costs for each cost category. This budget serves as a financial plan for the period.

- Monitoring and Controlling: Throughout the budget period, the company tracks its actual spending against the budgeted amounts. This enables the company to identify variances and take corrective actions.

The use of cost categories in budgeting provides a clear and organized structure for financial planning. It allows management to easily identify the major cost drivers, track spending, and make informed decisions. For example, if the actual cost of direct materials exceeds the budgeted amount, management can investigate the reasons for the variance and take steps to reduce future costs, such as negotiating better prices with suppliers or reducing waste.

Analyzing Cost Variances with Cost Categories

Cost variance analysis is a critical component of cost control and performance evaluation. It involves comparing actual costs to budgeted costs to identify and understand any differences. Cost categories provide the framework for this analysis, allowing organizations to pinpoint the sources of cost variances and take corrective actions.The basic formula for calculating a cost variance is:

Cost Variance = Actual Cost – Budgeted Cost

A positive variance indicates that actual costs exceeded budgeted costs (unfavorable), while a negative variance indicates that actual costs were less than budgeted costs (favorable). Variances are typically analyzed by cost category to identify the specific areas where costs deviated from the plan.Consider the same manufacturing company producing widgets. After a period, the company’s actual costs are compared to the budgeted costs.

The following table illustrates an example of cost variance analysis:

| Cost Category | Budgeted Cost | Actual Cost | Variance | Favorable/Unfavorable |

|---|---|---|---|---|

| Direct Materials | $50,000 | $55,000 | $5,000 | Unfavorable |

| Direct Labor | $30,000 | $28,000 | ($2,000) | Favorable |

| Manufacturing Overhead | $40,000 | $42,000 | $2,000 | Unfavorable |

| SG&A Expenses | $20,000 | $21,000 | $1,000 | Unfavorable |

In this example:

- Direct Materials Variance: The unfavorable variance of $5,000 suggests that the company spent more on direct materials than budgeted. This could be due to increased material prices, higher-than-expected usage, or both.

- Direct Labor Variance: The favorable variance of ($2,000) indicates that the company spent less on direct labor than budgeted. This could be due to improved efficiency, lower labor rates, or both.

- Manufacturing Overhead Variance: The unfavorable variance of $2,000 suggests that manufacturing overhead costs were higher than budgeted. This could be due to increased utility costs, higher depreciation expenses, or other factors.

- SG&A Expenses Variance: The unfavorable variance of $1,000 indicates that SG&A expenses were higher than budgeted. This could be due to increased marketing costs, higher administrative salaries, or other factors.

By analyzing the variances by cost category, the company can identify the specific areas where costs are not in line with the budget. The company can then investigate the causes of the variances and take corrective actions. For example, if the direct materials variance is unfavorable, the company might negotiate better prices with suppliers or implement measures to reduce material waste.

This detailed analysis enables management to make informed decisions and improve cost control.

Tools and Technologies for Managing Cost Categories

Effectively managing cost categories requires robust tools and technologies. These solutions streamline data collection, analysis, and reporting, providing valuable insights for informed decision-making. The integration of technology empowers businesses to gain a comprehensive understanding of their spending patterns and optimize resource allocation.

Software and Technology Assistance

Software and technology play a pivotal role in simplifying and enhancing the management of cost categories. They automate numerous processes, reducing manual effort and minimizing the risk of errors.

- Enterprise Resource Planning (ERP) Systems: ERP systems, such as SAP S/4HANA and Oracle NetSuite, offer comprehensive solutions for managing various business functions, including cost accounting. These systems integrate financial data with other operational data, providing a holistic view of costs across different departments and processes.

- Cost Accounting Software: Dedicated cost accounting software, like Sage Intacct and Xero, is specifically designed to track, analyze, and report on costs. These tools offer features such as job costing, activity-based costing (ABC), and variance analysis, enabling businesses to gain deeper insights into their cost structures.

- Spreadsheet Software: While not as sophisticated as ERP or dedicated cost accounting software, spreadsheet programs like Microsoft Excel and Google Sheets remain valuable tools for cost category management, especially for smaller businesses or for specific analyses. They allow for data organization, calculations, and basic visualizations.

- Business Intelligence (BI) and Data Visualization Tools: BI tools, such as Tableau and Power BI, are used to transform raw data into interactive dashboards and reports. These tools enable users to visualize cost category information, identify trends, and uncover areas for improvement.

- Cloud-Based Solutions: Cloud-based solutions offer advantages such as accessibility, scalability, and cost-effectiveness. These solutions allow businesses to access their cost data from anywhere with an internet connection and easily scale their systems as their needs evolve.

Data Visualization Techniques

Data visualization techniques are crucial for presenting cost category information in an accessible and understandable manner. Visual representations allow users to quickly identify trends, patterns, and anomalies in the data.

- Bar Charts: Bar charts are effective for comparing costs across different categories or time periods. They clearly show the relative magnitude of each cost category.

- Pie Charts: Pie charts are useful for illustrating the proportion of each cost category within the total cost. They provide a visual representation of the cost breakdown.

- Line Graphs: Line graphs are ideal for displaying cost trends over time. They help identify fluctuations and patterns in spending.

- Heatmaps: Heatmaps can be used to visualize cost data across multiple dimensions, such as cost category, department, and time period. They highlight areas of high and low spending.

- Scatter Plots: Scatter plots are useful for identifying correlations between different cost categories. They help to understand the relationships between various costs.

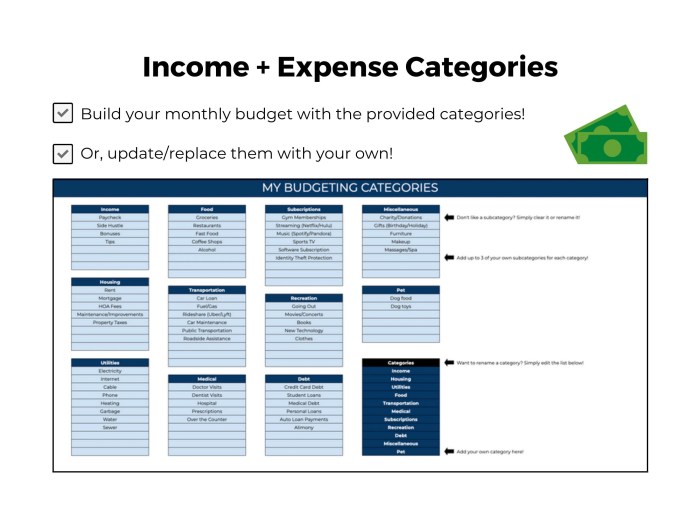

Dashboard Depiction

A dashboard provides a consolidated view of key cost category performance indicators. It presents information in an easy-to-understand format, enabling users to quickly assess the financial health of the organization.

The illustration depicts a financial dashboard designed to monitor cost category performance. The dashboard is organized into several key sections, each displaying relevant metrics and visualizations. At the top, a summary section presents overall financial performance, including total revenue, total expenses, and net profit. Below this, a series of interactive charts provides detailed insights into specific cost categories.

The first chart is a bar chart illustrating the total expenses for the current month, broken down by cost category. Each bar represents a cost category (e.g., direct materials, labor, overhead), and the height of the bar corresponds to the total expense for that category. Labels above each bar display the exact amount spent. The chart includes a color-coded legend to differentiate between the various cost categories.

To the right of the bar chart, a pie chart displays the percentage of total expenses for each cost category, offering a clear visual representation of the cost breakdown. Each slice of the pie is labeled with the category name and the percentage of total expenses it represents.

Below the charts, a table lists key performance indicators (KPIs) for each cost category. The table includes metrics such as actual cost, budgeted cost, variance (difference between actual and budgeted), and percentage variance. The table is designed to be interactive, allowing users to sort and filter the data. The rows are color-coded to highlight significant variances, with red indicating overspending and green indicating underspending.

The bottom of the dashboard includes a line graph showing the trend of total expenses over the past 12 months. The graph helps to identify seasonal patterns and long-term trends in spending.

This dashboard also includes a section for alerts and notifications, highlighting any significant deviations from the budget or any potential cost overruns. This section provides real-time feedback and allows for immediate corrective actions. Overall, the dashboard is designed to be user-friendly, providing a clear and concise overview of cost category performance. It enables users to quickly identify areas of concern and make data-driven decisions to optimize spending and improve profitability.

Conclusive Thoughts

In conclusion, the effective utilization of cost categories is an essential element for businesses of all sizes. By carefully defining and managing these categories, companies can unlock significant advantages, including enhanced financial visibility, improved cost control, and more informed strategic planning. From the basic understanding of direct and indirect costs to advanced techniques like activity-based costing, the journey through cost categories is a journey toward financial clarity and success.

Implementing these strategies ensures that organizations not only track their spending effectively but also gain a competitive edge in the ever-evolving business landscape.

Detailed FAQs

What is the primary purpose of using cost categories?

The primary purpose is to organize and classify all business expenses, providing a structured way to track spending, analyze financial performance, and make informed decisions about resource allocation.

How do cost categories help with budgeting?

Cost categories provide a framework for creating realistic budgets. By understanding how costs are distributed across different categories, businesses can accurately forecast future expenses and monitor actual spending against budgeted amounts.

What are some common challenges in implementing cost categories?

Challenges include the complexity of categorizing expenses accurately, ensuring consistency across different departments, and selecting the appropriate cost category structure to align with business needs. Data accuracy and regular review are also key.

How do cost categories impact profitability analysis?

Cost categories enable businesses to analyze profitability by providing a clear view of the costs associated with producing goods or services. This insight helps identify areas where costs can be reduced or where pricing strategies can be adjusted to improve profit margins.